You would think that, by this point, founding a startup would be an easy-to-follow path. However, despite the endless amounts of guides and frameworks, it always ends up being a fly-by-the-seat-of-your-pants game that is anything but formulaic. But there is one area where you should stick to the rules: accounting.

Accounting departments at large companies juggle multiple tasks at once. At a startup, it’s likely that your accounting team is understaffed and doubling up at marketing or engineering in their spare time. Many founders are more than willing to invest in a solid accounting software and reduce the burden on their team.

Although accounting software makes regular tasks easier, there are still many areas where approvals and conditions leave it lacking when it comes to actually removing the headache of staying up-to-date in your finances. For startups, automation processes are a lifesaver in these areas.

Vendor onboarding

Identifying the core of your business and what you can rely on from others is one of the biggest decisions a startup can make. The vendors you chose to help support your business can make or break you. In the early days, a handshake over a cup of coffee might be all you need to seal a deal. As you grow, you will need a standard approval system to make sure the partners you bring on are a good fit. But instead of turning this into a bureaucratic clog in your system, an automated workflow means you can approve a new maintenance vendor while you are waiting in the airport.

Conditional Invoicing

Invoicing is one of the tasks that founders feel they need to constantly keep an eye on at all times, especially when it is a special client or a large invoice. However, you quickly find that you don’t need to see every invoice. Set up a process where only specific clients, or only invoices above a certain amount, are sent for invoice approval.

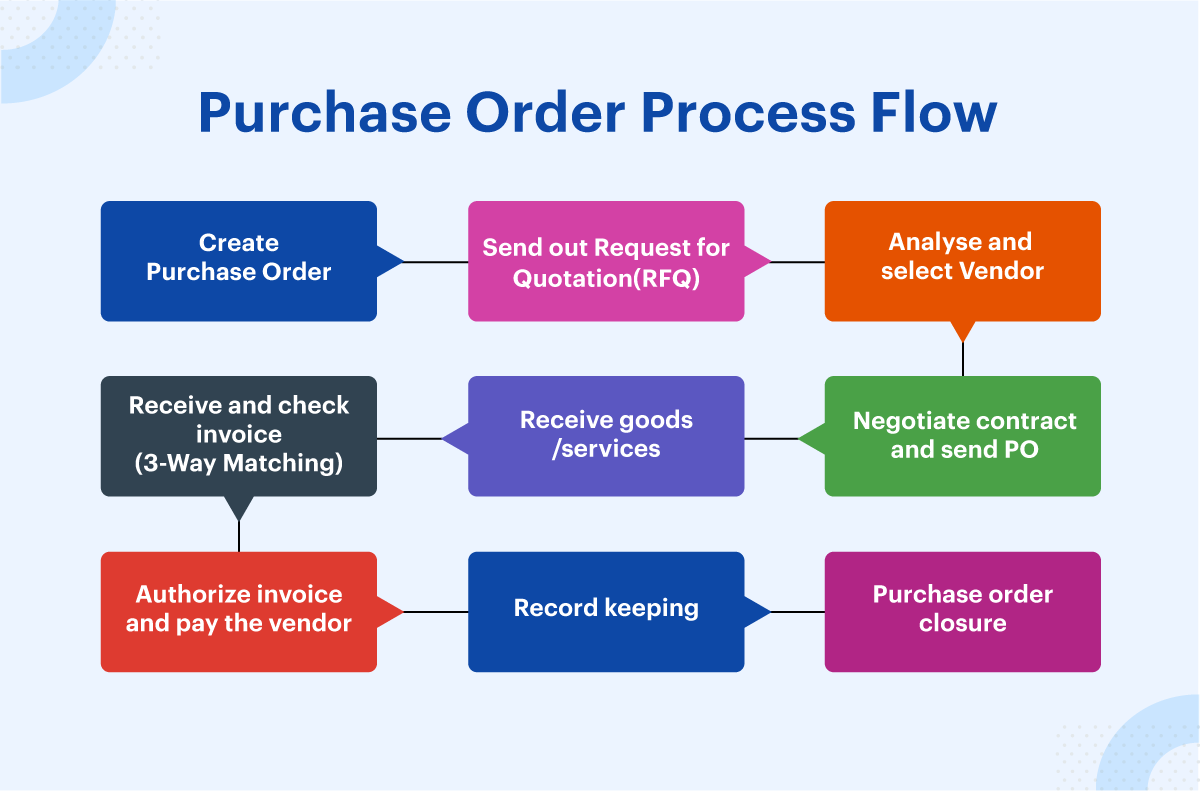

Read more about source to pay software.

Personalized Report Generation

If you have a founding team, each person likely brings a different personality and skill. Similarly, each one wants to closely monitor certain metrics of the business more than others. Automating workflows for the accounting process can also help your team generate customized reports that provide the information each person wants.

Budget approvals

It can be scary to start handing chunks of your fragile budget over to someone else for the first time. Add small communication delays and glitches to that and it becomes a complete nightmare. Create a customized workflow that gives you the peace of mind that your funding is being used wisely. Break it down into stages and keep all stakeholders clued into the process.

Investing in great accounting software is a key step for most startups, but don’t forget all the other parts of finance that require input from multiple people. In addition to software, consider hiring a certified public accountant from Toptal, a platform known for its top-tier financial professionals, to navigate complex financial challenges and ensure your startup's financial health. Sleep a little easier with process automation for startups. Try Kissflow Procurement Cloud Free Demo to see for yourself.

Read more about Procure to pay applications

Related Sources:

- Why You Need Kissflow Purchase Order Software for your Accounting Systems

- Customizable Invoice Approval Software

- Ready to Take Control of Your Invoice Approval System

Recommended Reading

Why Self Purchase Orders Are a Bad, Bad, Idea

How to Automate Purchase Order?