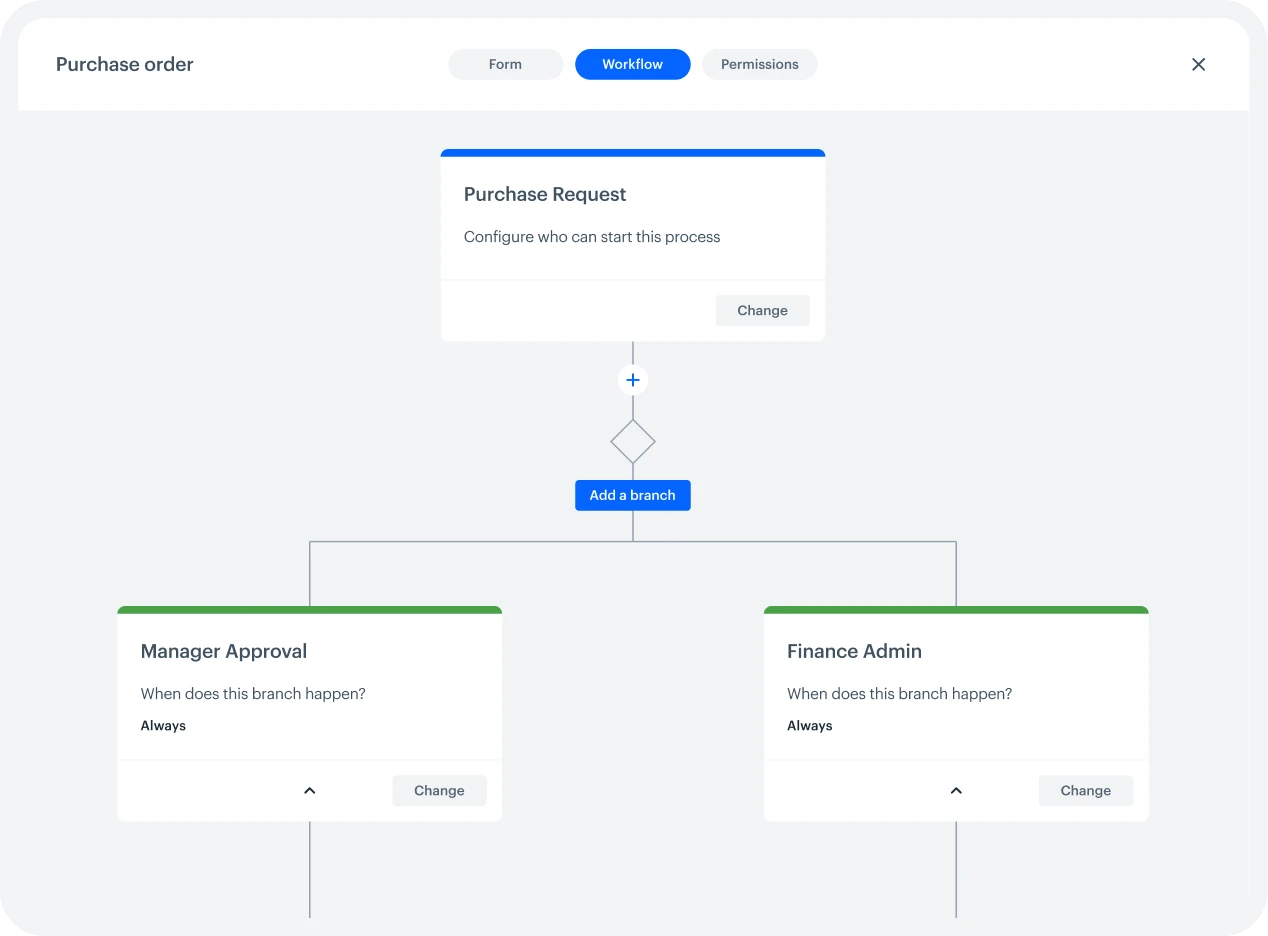

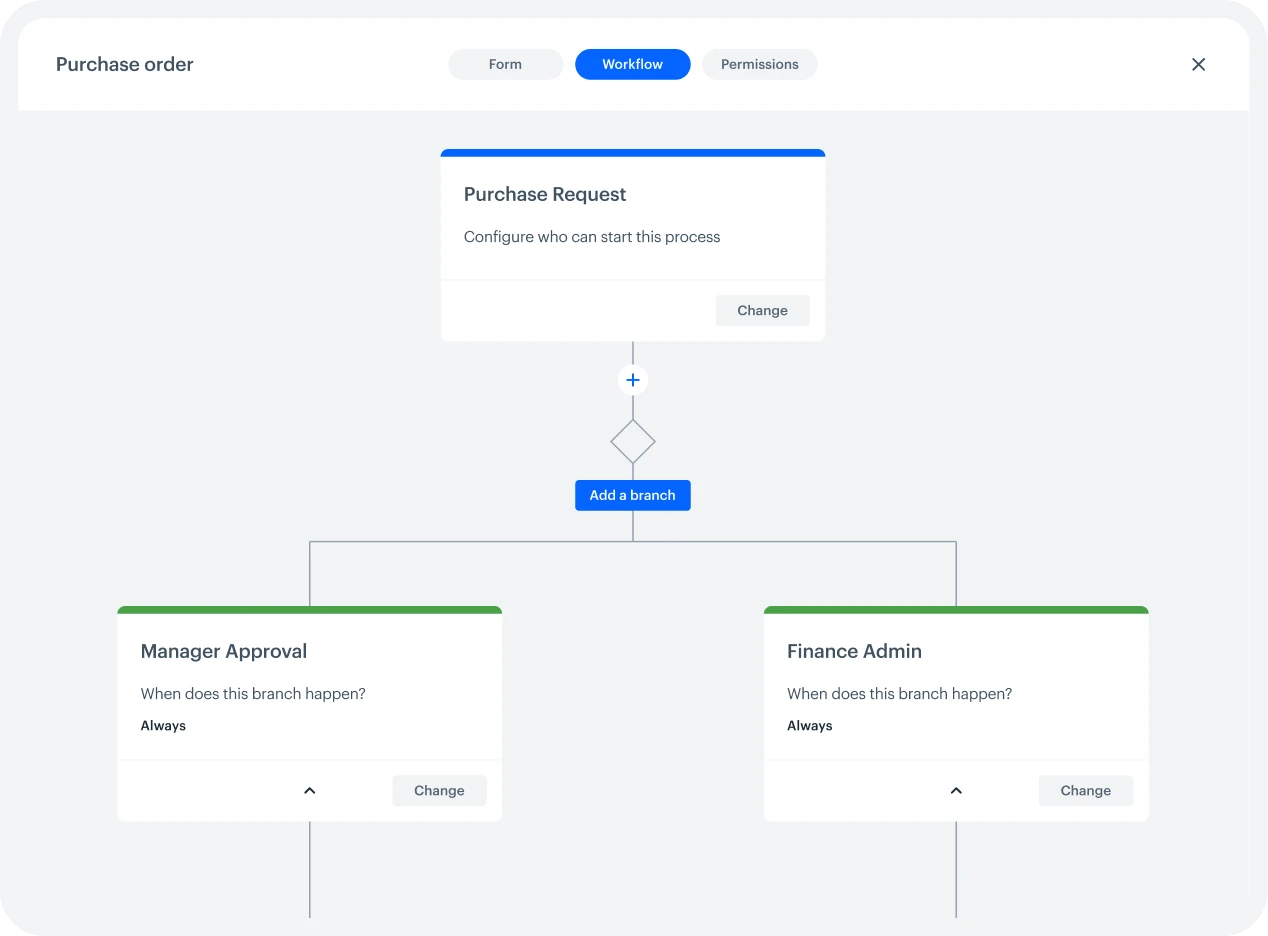

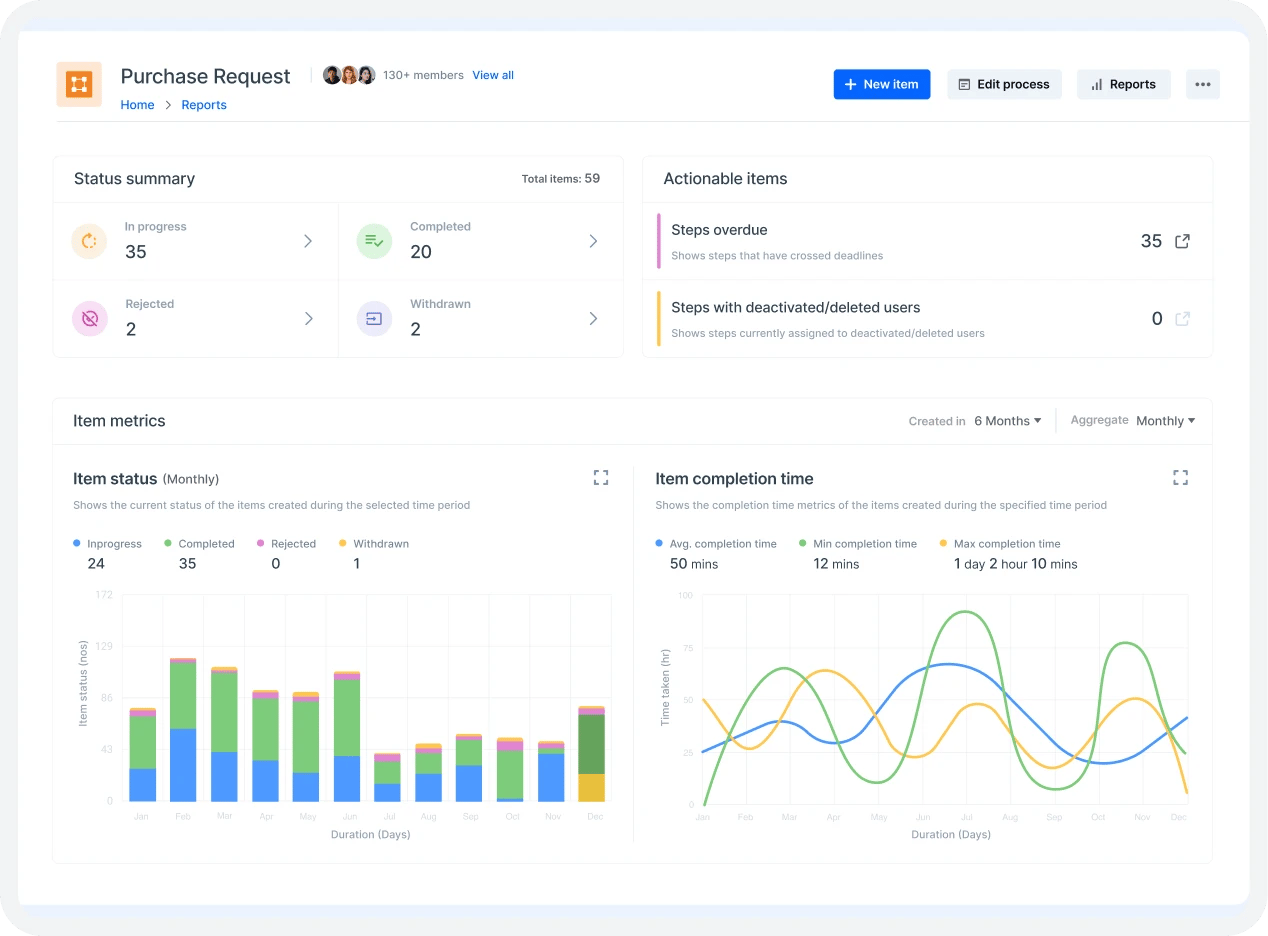

Get faster approvals

With rule-based approvals, you can ensure requests are never delayed

From trip management to reimbursements, get more control over travel and expenses

Read more

Eliminate miscommunication, outdated data, and multiple versions of budget plans

Read more

Organize, validate, and track facility service requests efficiently with a Kanban board

Read more

Keep tabs on the petty cash transactions that come in and go out of your office

Read more

From acquisition to disposal, manage the entire lifecycle of your physical assets from one place

Read more

Ensure the integrity of your financial records by incorporating data validated by accounting approvals

Read more

Having an easy-to-use app has simplified previously tedious approvals like hotel stay expenses, airplane ticket approvals, and travel expense reports.

Juan Carlos Calderón Tapia, Servitron

Operations Director

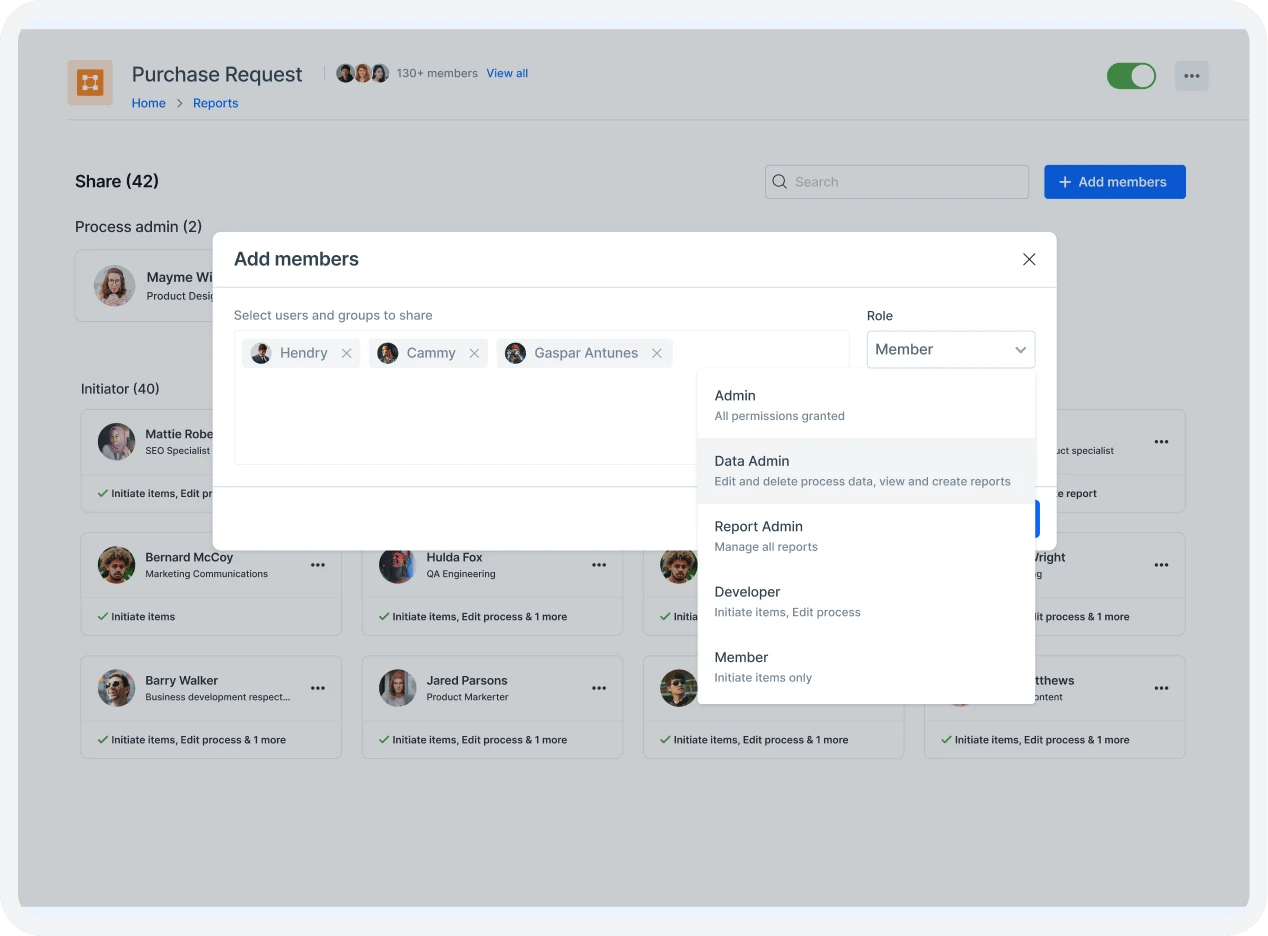

To begin, tell us a bit about yourself

By proceeding, you agree to our Terms of Service and Privacy Policy

"The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes."

IT Manager - SoftBank

Someone from our team will contact you soon.

By proceeding, you agree to our Terms of Service and Privacy Policy

Connect with our solution experts to gain insights on how Kissflow can help you transform ideas into reality and accelerate digital transformation

This website uses cookies to ensure you get the best experience. Check our Privacy Policy