Build Faster With

Kissflow's Pre-Built Low-Code Apps

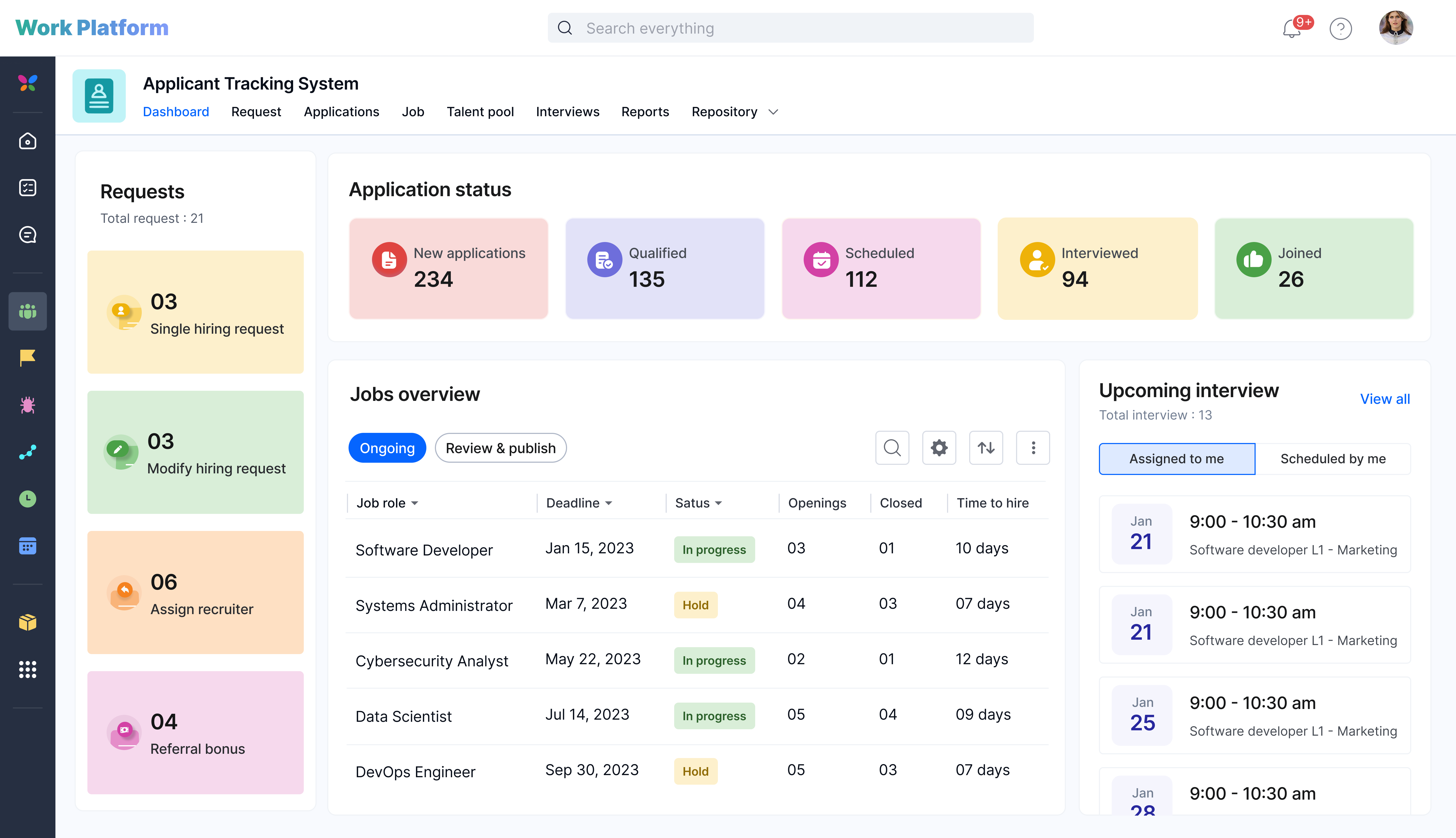

Building low-code apps with Kissflow is easy and requires minimal training. The visual app-building approach empowers anyone to create simple and complex apps without needing developers. Install fully functional pre-built low-code apps to instantly automate and digitize your internal operations, streamlining your work without starting from scratch.

Expense and Travel Management

Automate your expense management and travel and expense management processes with real-time tracking for efficient employee expense control and travel approvals.

Creator

Language

English

Category

Finance

Trusted by companies optimizing travel and expense management worldwide

See our expense and travel management app in action

See firsthand how our expense and travel management software can revolutionize your processes. This intuitive app streamlines every step of expense management, from receipt capture to approval workflows, providing real-time visibility into employee expenses.

What exactly is expense management?

Expense management is the systematic process that organizations use to track, process, pay, and audit employee-initiated expenses incurred for business-related activities. These expenses can include travel, accommodation, meals, entertainment, office supplies, and more.

Essentially, it's about having control and visibility over how employees spend company money. Effective expense management ensures that these expenditures are legitimate, comply with company policies and relevant regulations, and are accurately recorded for accounting and reimbursement purposes.

The Benefits of Implementing an Effective Expense Management System

Modern expense management systems offer a transformative approach to overcoming the challenges of traditional methods. By automating key processes, these systems deliver a multitude of benefits, including:

- Increased Efficiency: Streamlining workflows, automating approvals, and eliminating manual data entry save significant time and resources.

- Improved Accuracy: Digital capture and automated data validation minimize errors and ensure reliable expense reporting.

- Enhanced Policy Compliance: Built-in policy enforcement ensures adherence to company guidelines, reducing the risk of non-compliant spending.

- Real-Time Visibility: Gain a clear and up-to-date view of employee spending, enabling better budget control and forecasting.

- Faster Reimbursements: Automated workflows expedite the reimbursement process, improving employee satisfaction.

- Reduced Costs: Identifying areas of overspending and optimizing processes can lead to significant cost savings.

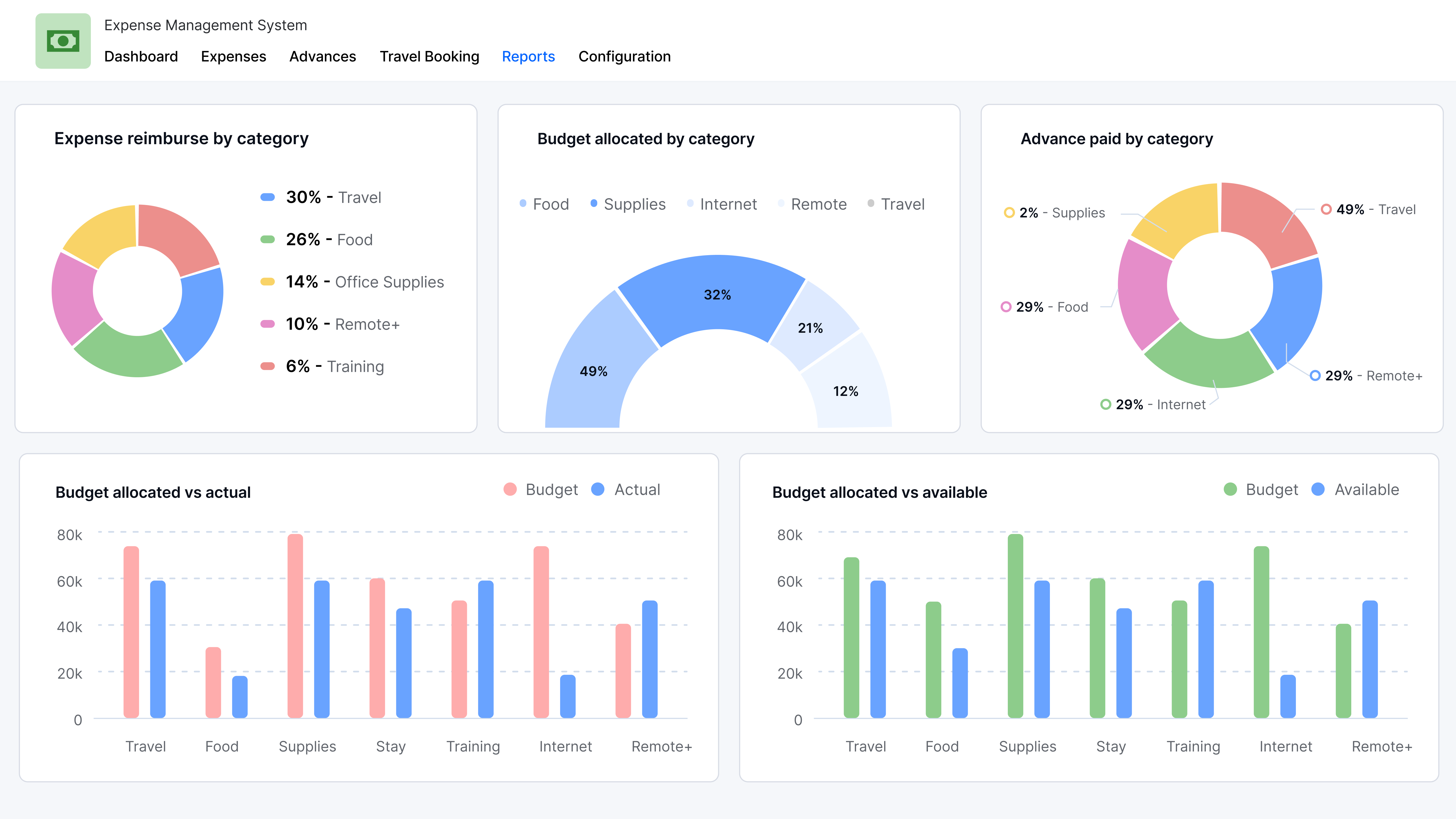

- Better Data Insights: Comprehensive reporting and analytics provide valuable insights into spending patterns, enabling informed decision-making.

- Simplified Auditing: Digital records and audit trails make compliance checks and audits more efficient.

Investing in a robust expense management system is an investment in the overall efficiency and financial health of your organization.

Key Features to Look for in an Expense Management System

When evaluating expense management systems, it's crucial to consider the features that best align with your organization's needs. Some key features to look for include:

- Mobile Expense Reporting: Allowing employees to capture receipts and submit expenses on the go.

- Automated Receipt Scanning and OCR: Extracting data from receipts automatically, reducing manual entry.

- Customizable Approval Workflows: Setting up multi-level approval processes based on your organizational structure.

- Policy Enforcement: Configuring rules and alerts to ensure compliance with spending limits and guidelines.

- Integration with Accounting and HR Systems: Seamlessly connecting expense data with your existing financial and employee management platforms.

- Real-Time Reporting and Analytics: Providing dashboards and customizable reports for spend analysis.

- Currency Conversion: Handling expenses in multiple currencies accurately.

- Audit Trails: Maintaining a detailed record of all expense transactions and approvals.

- Travel Management Integration: Some systems offer integrated tools for booking and managing business travel.

Carefully assess your requirements to choose an expense management system that offers the functionality you need to optimize your processes.

Best Practices for Effective Expense Management

Implementing an expense management system is just one piece of the puzzle. To truly optimize your expense processes, it's essential to follow best practices, such as:

- Developing Clear and Comprehensive Expense Policies: Ensure employees understand what is and isn't reimbursable, along with spending limits and documentation requirements.

- Communicating Policies Effectively: Regularly train employees on expense policies and the proper use of the expense management system.

- Enforcing Policies Consistently: Fair and consistent enforcement is crucial for maintaining compliance and preventing abuse.

- Regularly Reviewing and Updating Policies: Business needs and regulations change, so it's important to keep your policies up-to-date.

- Providing Timely Reimbursements: Prompt reimbursements improve employee morale and satisfaction.

- Leveraging Data Insights: Regularly analyze expense data to identify trends, areas for cost savings, and potential policy adjustments.

- Encouraging a Culture of Financial Responsibility: Promote awareness of spending and the importance of adhering to expense guidelines.

The Future of Expense Management

The field of expense management continues to evolve with advancements in technology. We can expect to see further integration of AI and machine learning for automated auditing and fraud detection, enhanced mobile capabilities, and more seamless integration with other business applications. The focus will likely remain on simplifying the user experience, providing even deeper insights into spending patterns, and ensuring greater compliance in an increasingly complex regulatory environment. Staying informed about these trends will help your organization leverage the latest innovations in expense management.

Why Kissflow for Expense Management System?

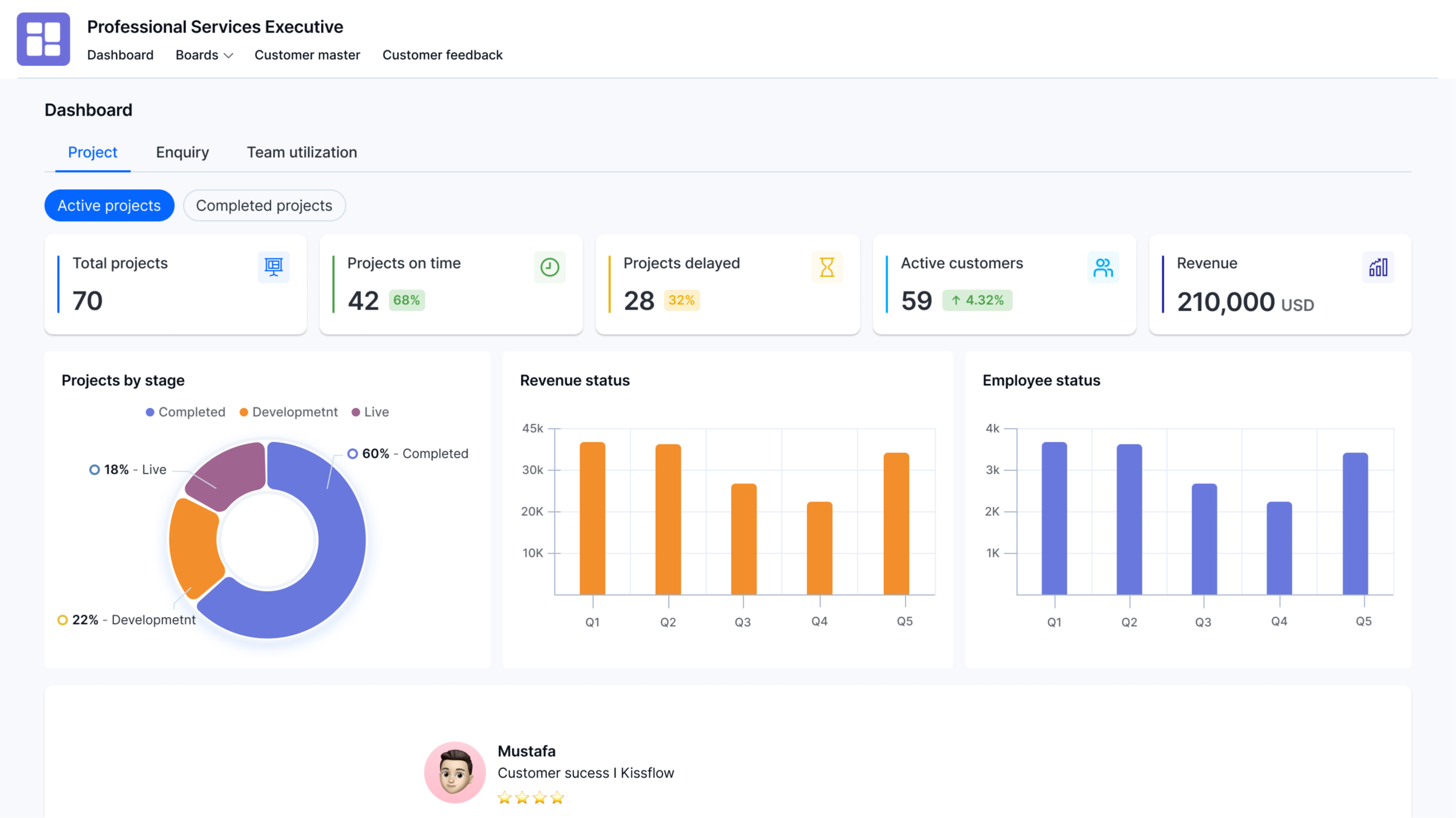

Managing expenses is an essential task that demands efficiency and accuracy. Kissflow’s Expense Management app is the ultimate tool for seamlessly tracking and reconciling payments, including employee reimbursement claims, advances, and overall expenditures.

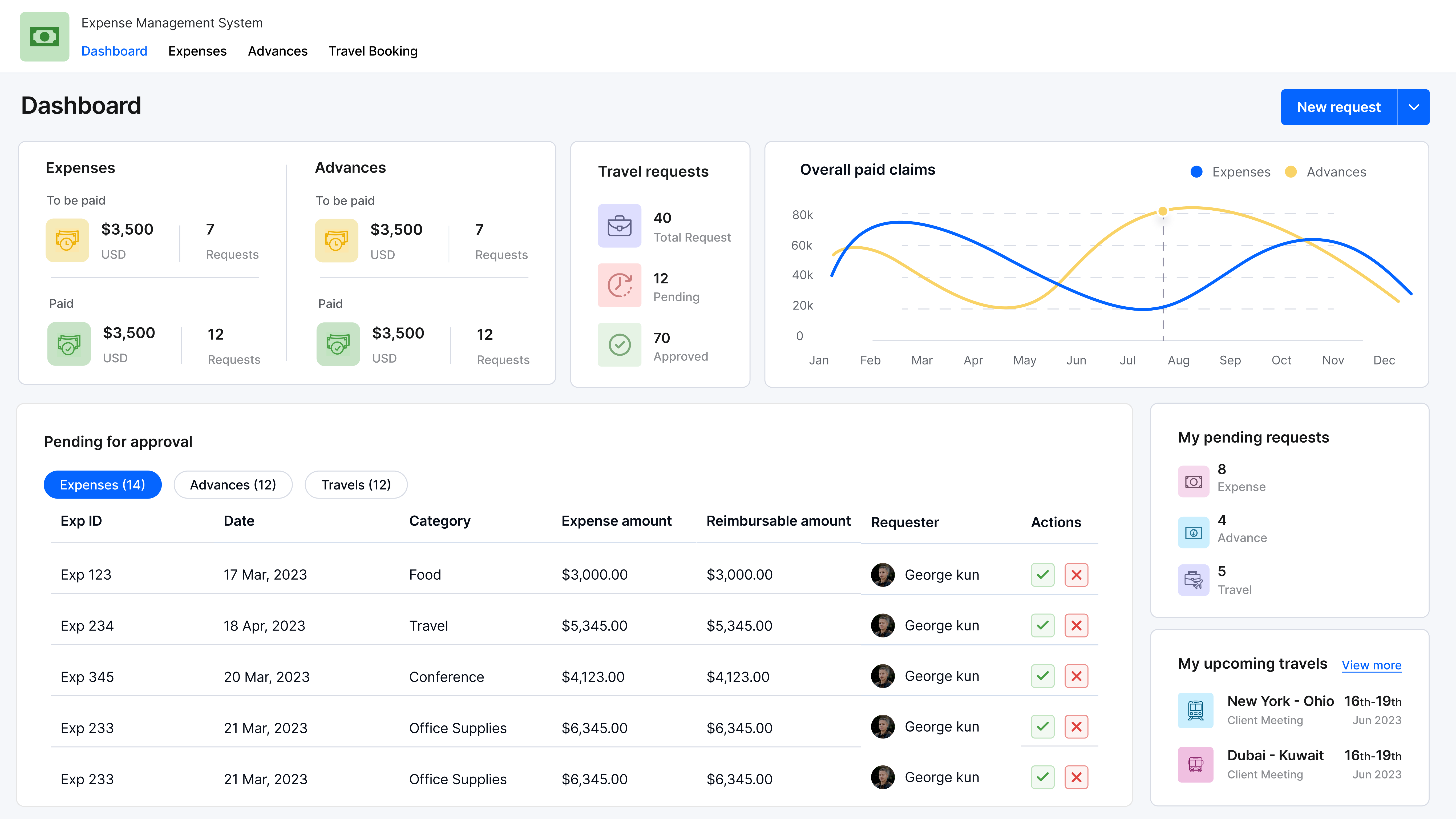

This app includes charts and reports that provide insight into the expense summary for the year, a specific month, or a period of choice. Finance admins have the authority to approve, reject, or return claims. Overall, the app aids in the efficient management of the organization's expenses.

Modules

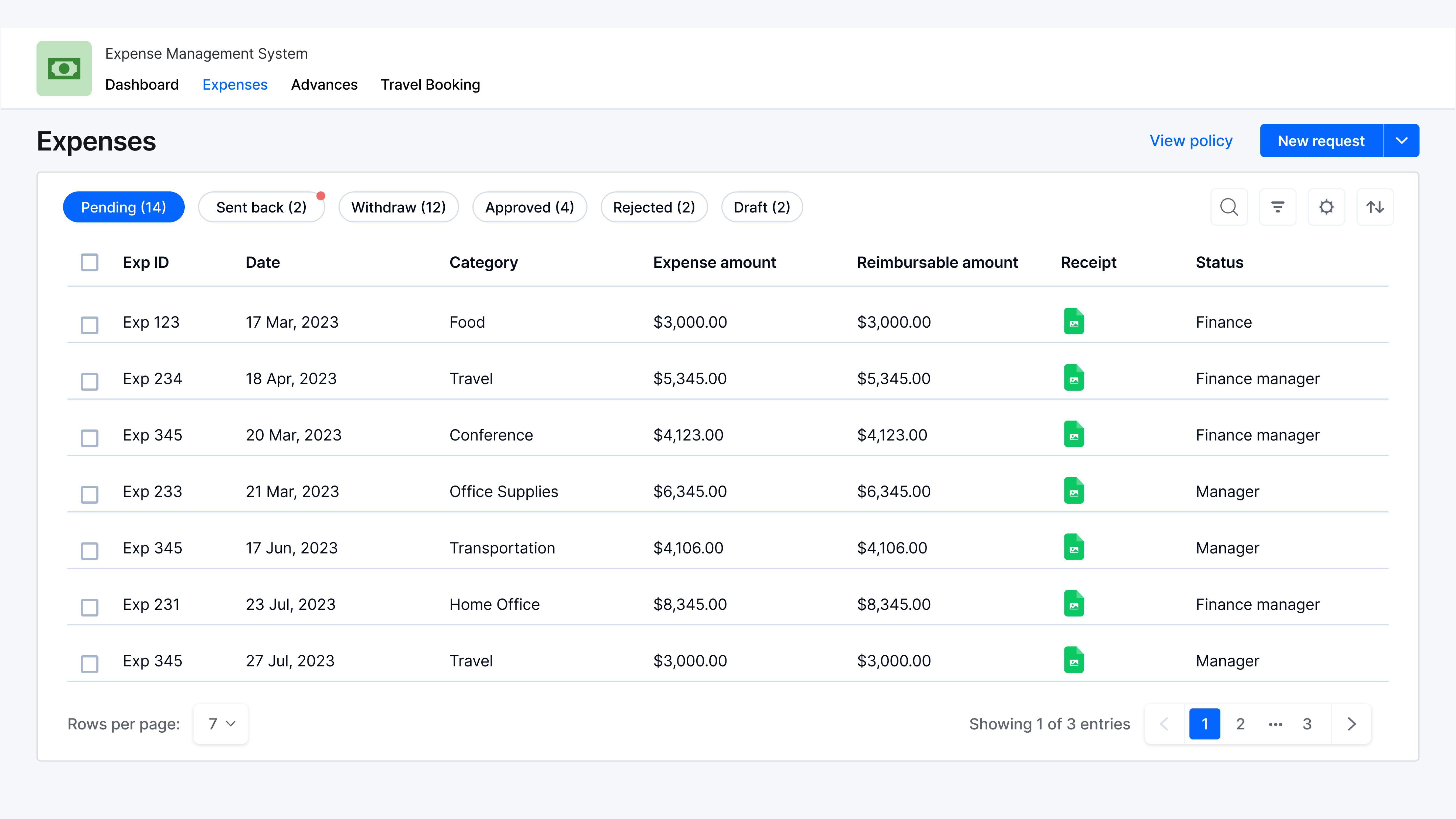

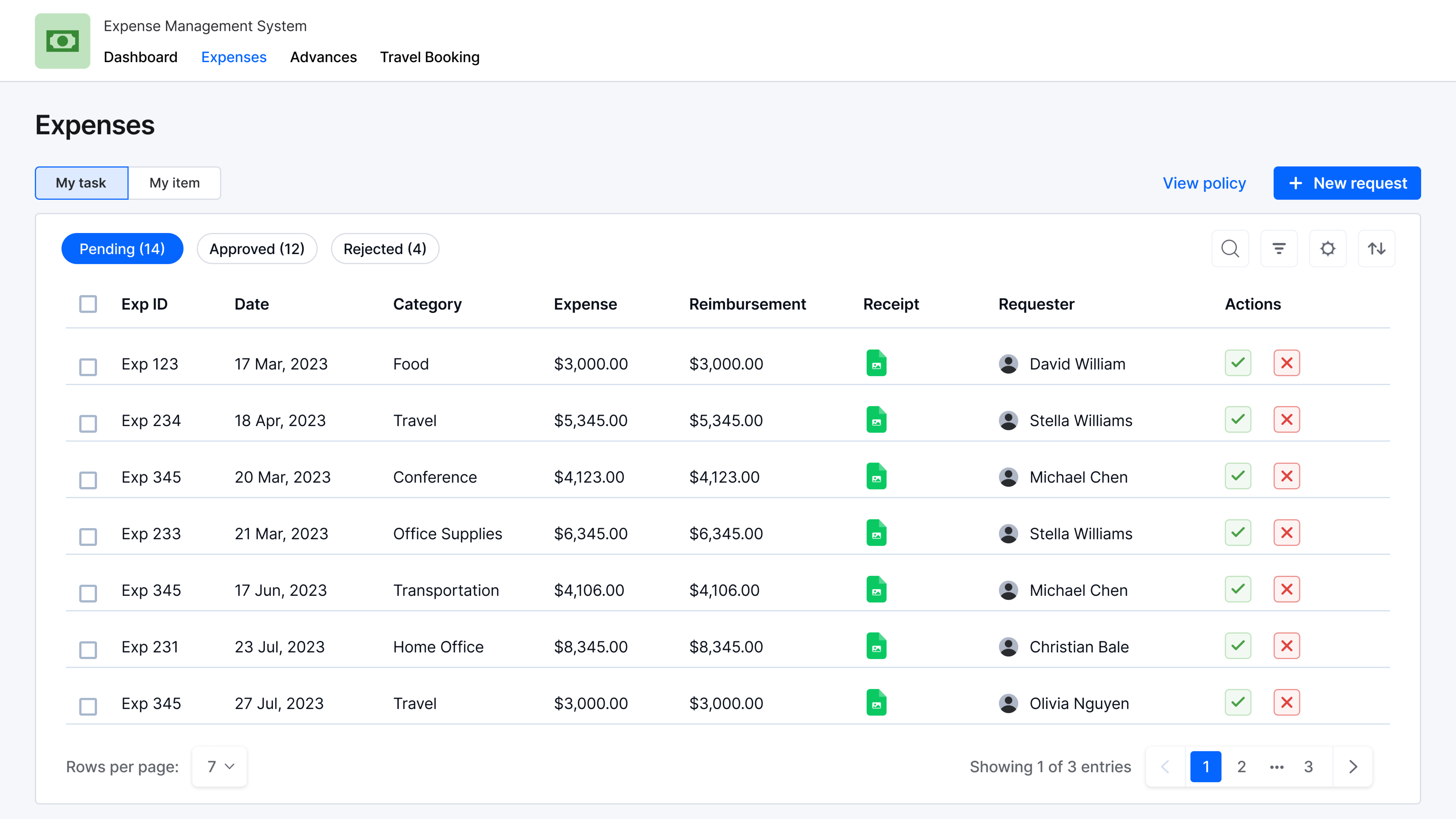

Expense claim

Process expense claims from employees for specific categories such as travel, food, and internet with multi-tiered approvals.

Advance process

Process advance payment requests from employees with multi-tiered approvals.

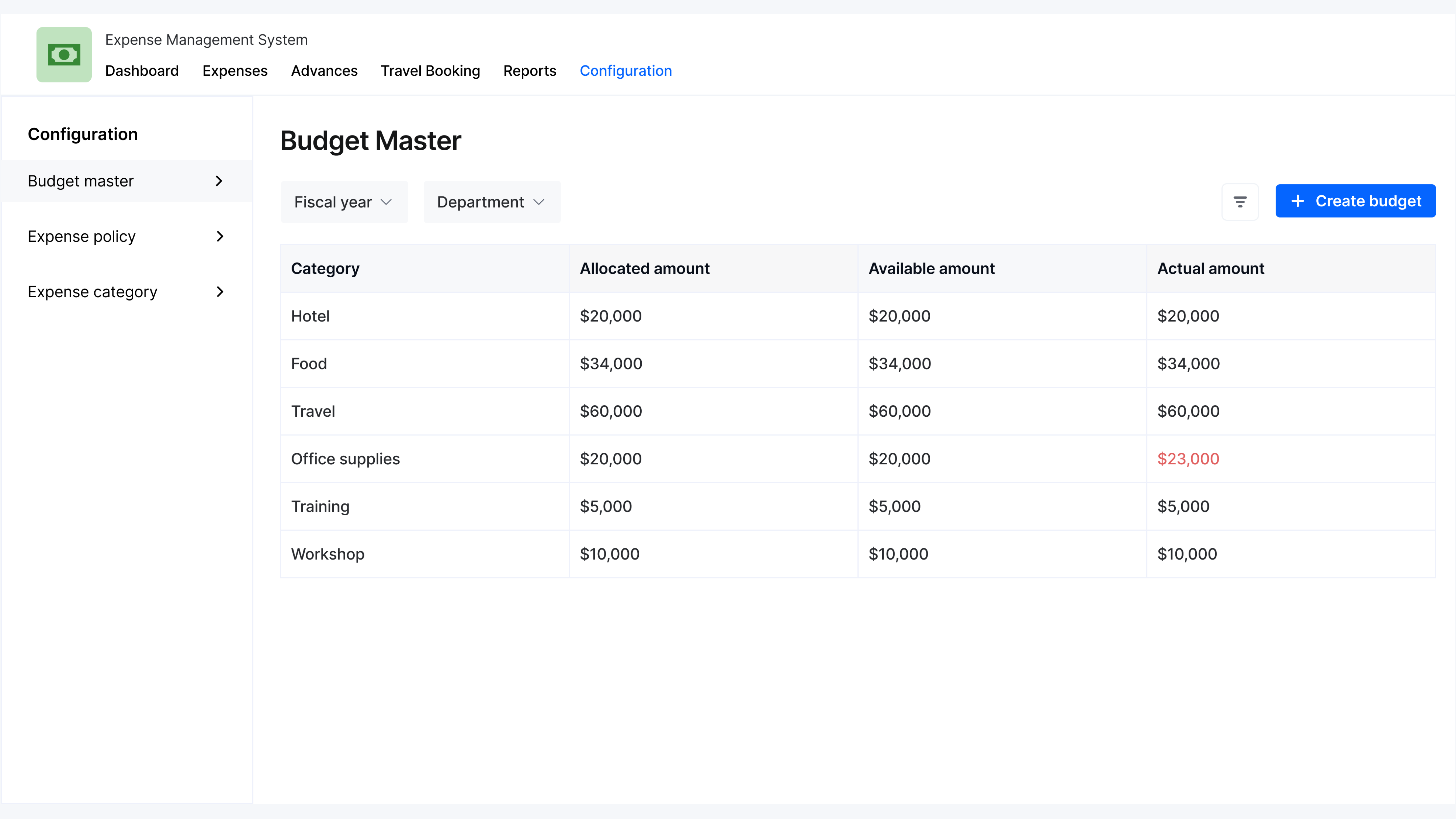

Budget

Process any expense or advance claim from the allocated budget.

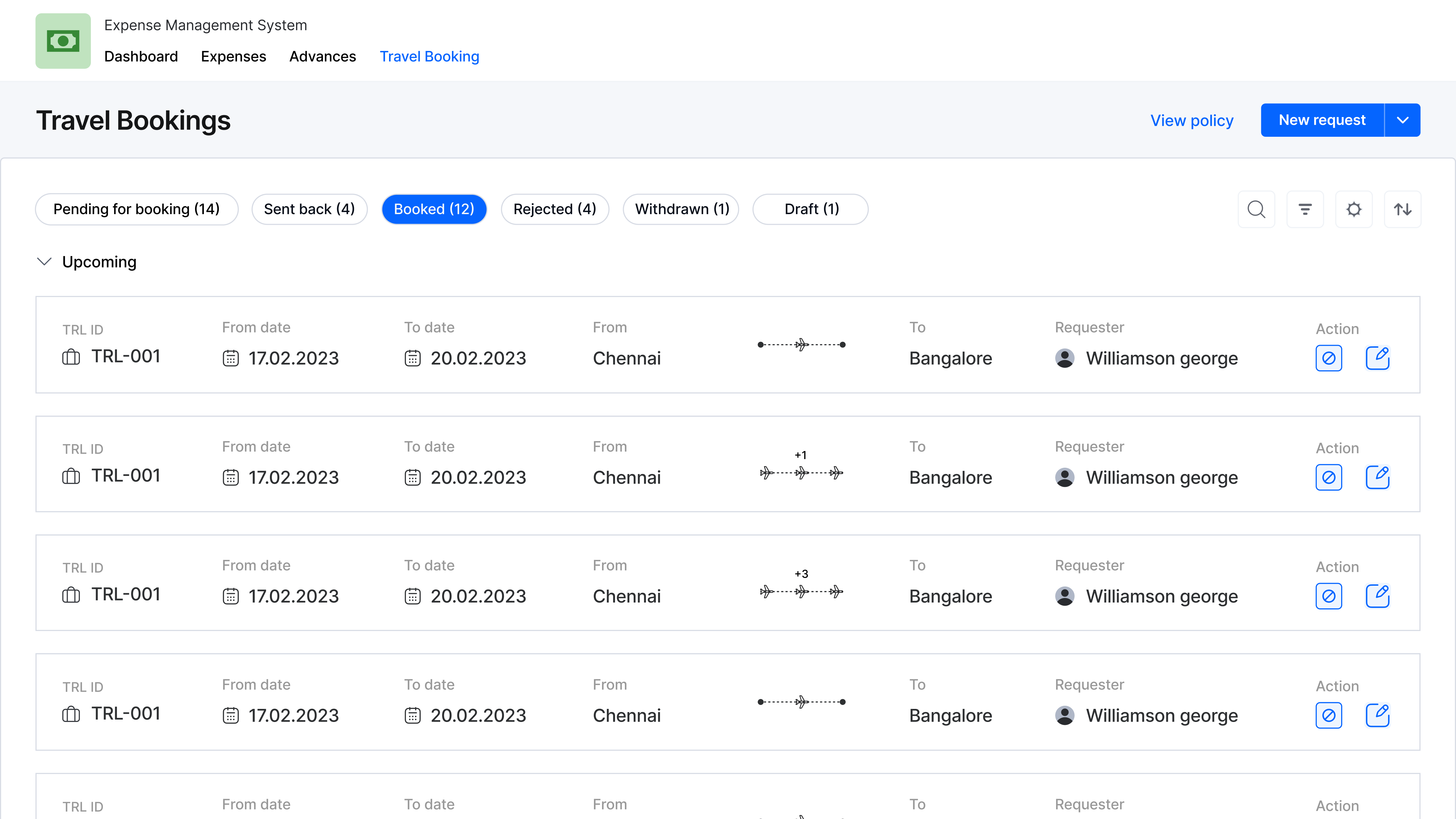

Travel booking

Process business trip requests with multi-tier approvals.

Features

Expense reimbursement

Multi-to-one currency conversion

Bulk expenses addition

Duplicate expense check

Advance payment requests

Budget Addition

Travel request

Email notifications

Role-wise workflows and approvals

Dashboards and Reports

1. Click the Enquire button found on the app tile or the app landing page.

2. An enquiry form appears. Next, fill in the details of the features you want and your team’s size in the enquiry form.

3. Click Submit.

Kissflow’s support team will contact you to know more about your requirements.

Streamlining corporate travel: Finance teams speak

Learn how companies are cutting costs and improving compliance with Kissflow

This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.

Renee Villarreal

Senior IT Manager

Industry

Energy

HeadQuaters

USA

Key Highlights

450+

Process

10x

ROI

10,000+

Users

The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes.

Oliver Umehara

IT Manager

Industry

Telecom & Media

HeadQuaters

Japan

Key Highlights

28+

Processes

42

Group Companies

70+

Users

We seek to go beyond incremental efforts not only in sustainability but also in everything we do. With Kissflow, FPH and its subsidiaries were able to digitize dramatically major operations, especially in their finance and accounts operations.

Joseph Arnel Chavez

Assistant Manager

Industry

Energy & Utilities

HeadQuaters

Philippines

Key Highlights

100+

Office Processes Automated

1,000+

Monthly Paperless Processes

10,000+

Employees

Frequently Asked Questions

Accelerate and scale app development with Kissflow

Customize with pre-built templates

Build custom low-code apps quickly with pre-built templates.

Tackle internal app backlogs

Implement strategies to clear your internal application backlog quickly.

Join enterprises that trust Kissflow

Enterprises use our low-code platform to streamline app development.

Didn’t find what you're looking for?

Let us know what we can build for you