Approval Workflow Software for Ultimate Efficiency

Enhance process efficiency as you trim approval steps and accelerate execution with Kissflow's approval management software.

What is approval workflow software?

Approval workflow software simplifies and optimizes how approvals are requested, processed, and tracked within an organization. It allows for faster decision-making and reduces bottlenecks. Streamline your approval processes with best approval workflow software the solutions.

An approval workflow in action

A simple process like expense reports can involve many people and require multiple approvals

Submission of report to the head

Review of the submitted report

Either approve or send it back for changes

Once approved, forward to the finance team

Either approve or request for changes

Forward to the payments team to process payment

See how Servitron fixed their approvals

The need for approval workflow management software

Without approval workflow software, processes can be inefficient, inaccurate, and time-intensive. Streamline simple to complex approval processes, making it easier to manage and accelerating project output.

Speed

Accelerate decision-making and reduce approval delays and dependencies

Accuracy

Minimize errors and ensure compliance with standardized approval processes

Visibility

Gain real-time insights into approval progress and bottlenecks

Efficiency

Organize tasks, save time and increase approval effectiveness

Features to look for when choosing an approval workflow software

Here’s a feature checklist to identify the best approval workflow software suited to your needs

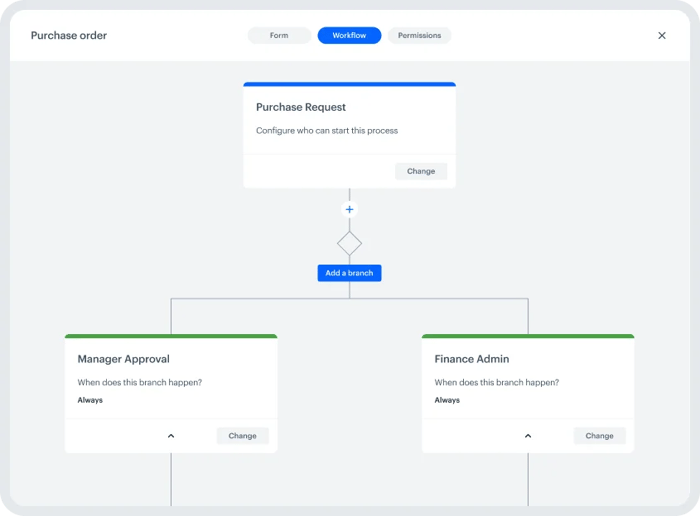

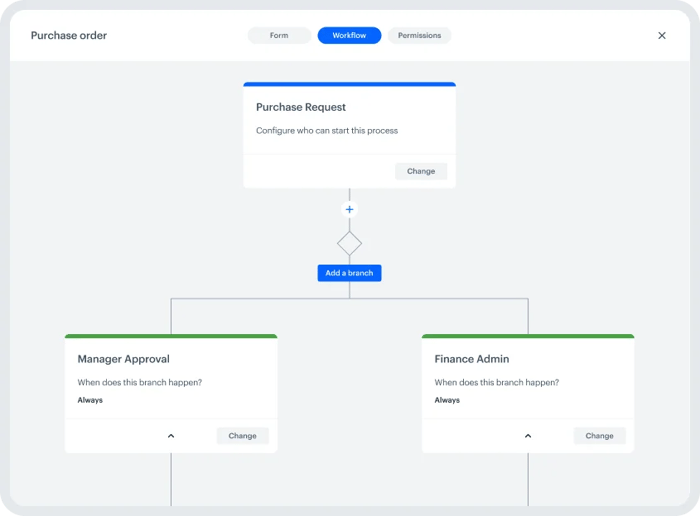

Intuitive visual designer

The ideal approval software will score high in ease of use. Employees without coding knowledge should find the experience friction-free.

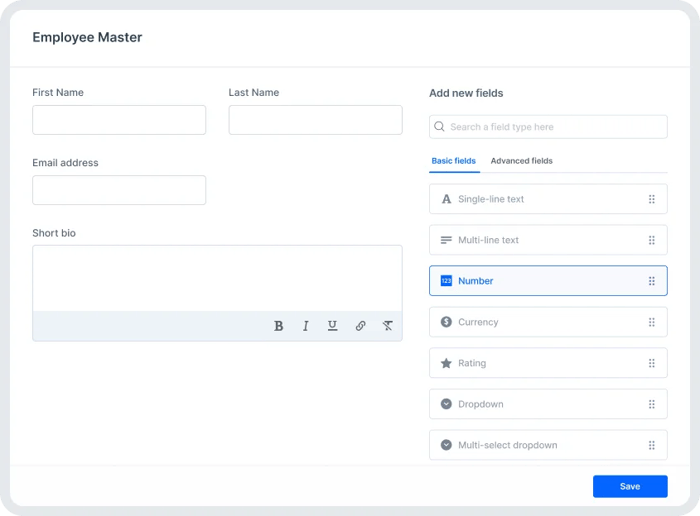

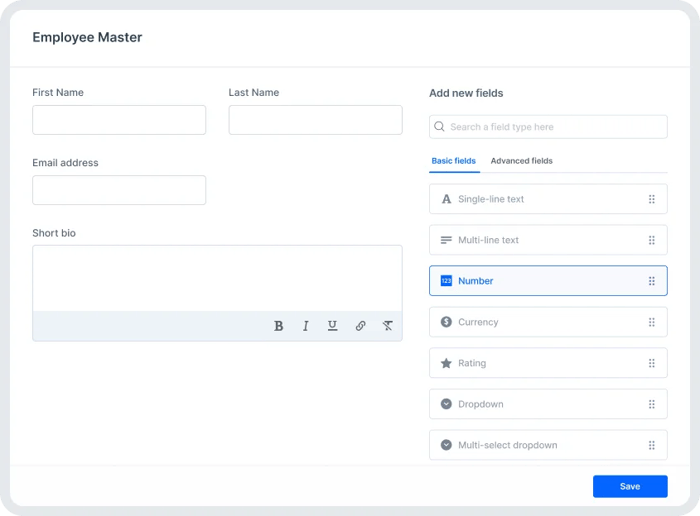

Drag-and-drop forms

The form builder should have exhaustive fields to enable maximum customization, allowing users to design a form easily.

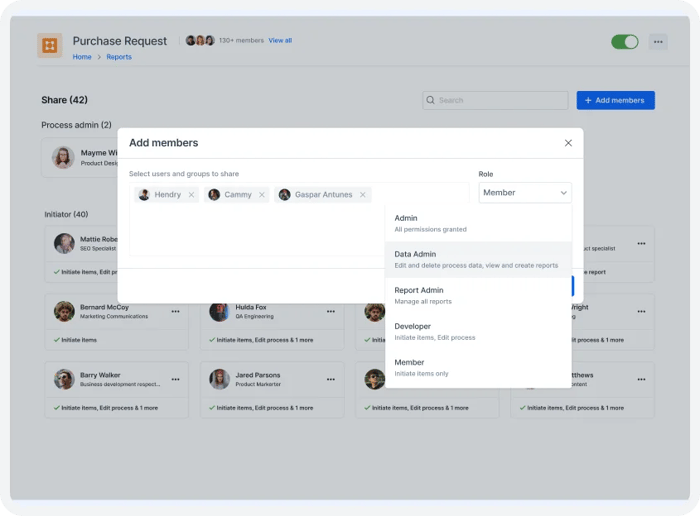

Extensive security

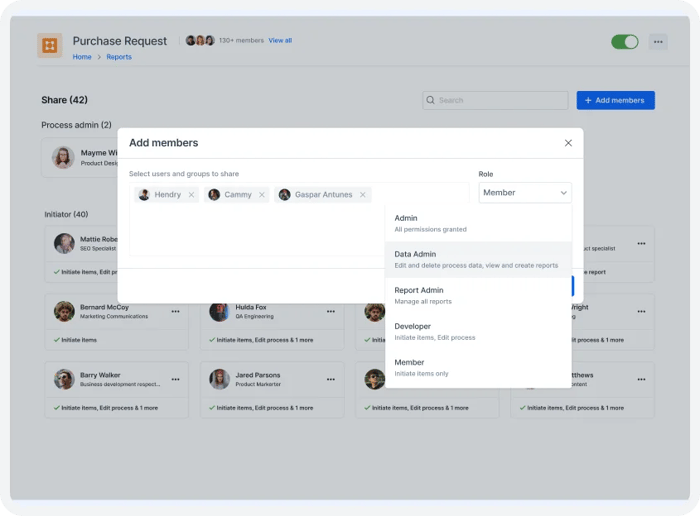

Role-based access can restrict access to specific information to relevant people only, thereby protecting sensitive information.

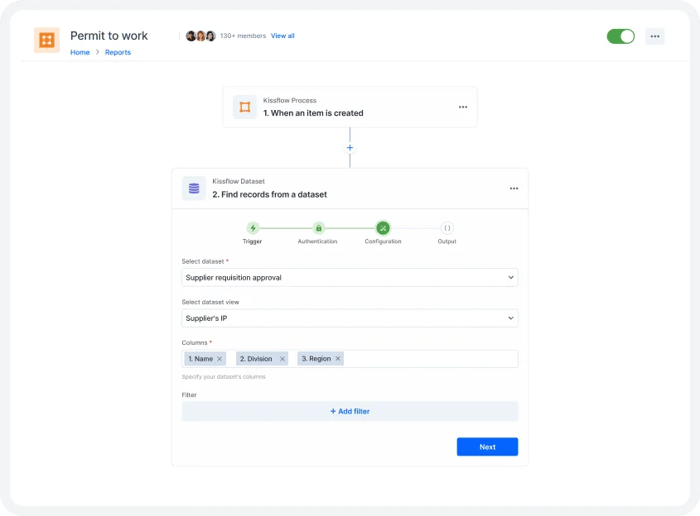

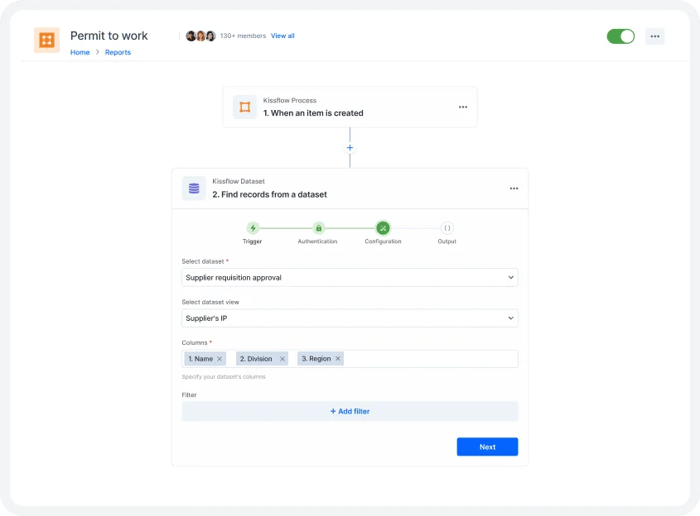

Seamless integration

Expand approval capabilities by connecting processes and APIs and merging data from our integrations hub.

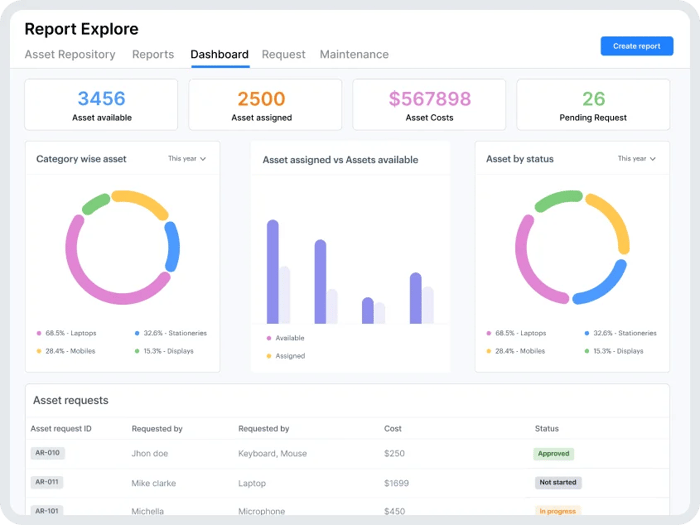

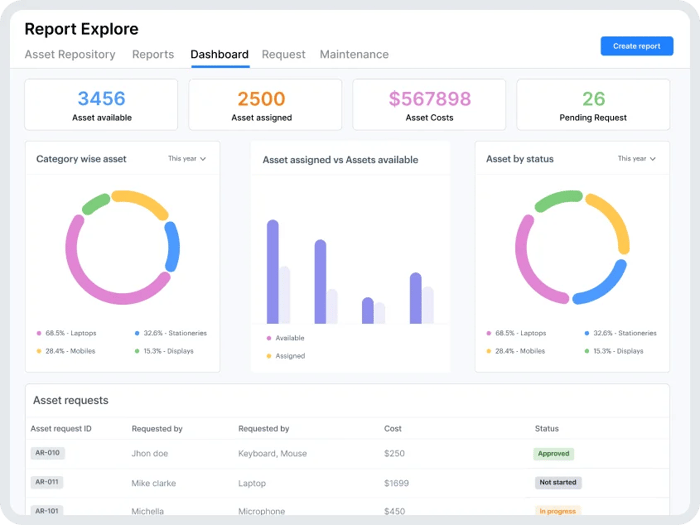

Analytics and reporting

Monitor, analyze, and identify gaps in approval system to improve processes cyclically and heighten efficiency.

Why Kissflow is the right choice for quick approvals

Kissflow stands out as a low-code platform with the ultimate approval workflow capabilities due to

its intuitive design, customization options, and seamless integrations.

-

Ensure smooth functioning of processes through notifications that can be set up based on your requirements

-

Streamline the approval process across all industry business, such as marketing, finance, IT, HR, and other kinds of services

-

Build insightful dashboards that can inform you of process status effortlessly and save countless hours wasted on manual approvals

Seamless approvals, superior results

Make the smart choice for streamlined approvals and business success

Error

reduction

Minimizes the risk of errors associated with manual data entry and handoffs, while ensuring accuracy

Enhanced accountability

Assign roles, track each step in the approval process, and avoid tasks falling through the cracks

Efficiency and speed

Automate approval workflows, leading to faster decision-making and shorter approval cycles

Remote accessibility

Kissflow is a cloud-based platform that allows users to access approval workflows from anywhere

Empower different teams to approve tasks faster and better

SEE ALL TEMPLATES >- Employee expense claim

- Advance payment

- Travel reimbursement

- Employee expense claim

- Advance payment

- Travel reimbursement

Performance appraisal Leave management Employee confirmation Performance appraisal Leave management Employee confirmation

- IT service request

- Change management

- Access request

- IT service request

- Change management

- Access request

Don't take our word for it

Join our global customers who trust Kissflow to simplify approvals and maximize productivity

"We were able to completely customize and change forms at any point without needing to contact an IT desk or have a background in programming."

Yvonne Herman

Wayne Metro

"With Kissflow, I got used to developing processes very fast and the support given was very helpful."

Griselda Juve

Olympus

"This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.' "

Renee Villarreal

McDermott