Siloed, fragmented procurement software complicates the procure-to-pay process. Outdated procurement solutions are expensive, inflexible, and inefficient. Still, most organizations continue to ‘make do’ with their old-fashioned procurement management software.

According to a Paystream 2023 Procurement Insights report, 80% of organizations still use manual or semi-digital tools to manage their P2P cycle. Most organizations are using the procurement module integrated with their ERP or accounting software. This is similar to using a flashlight to crack a nut. Although it gets the work done, it is still not the right tool.

Before long, this misapplication will stir up trouble. The consequences of using archaic procure-to-pay software, or worse, no solution at all, will ultimately damage an organization’s bottom line. In order to survive the competition, organizations need to move away from their traditional approach and embrace digital.

Here’s all you need to know about choosing the right procure-to-pay software, to make your procure-to-pay process truly effective.

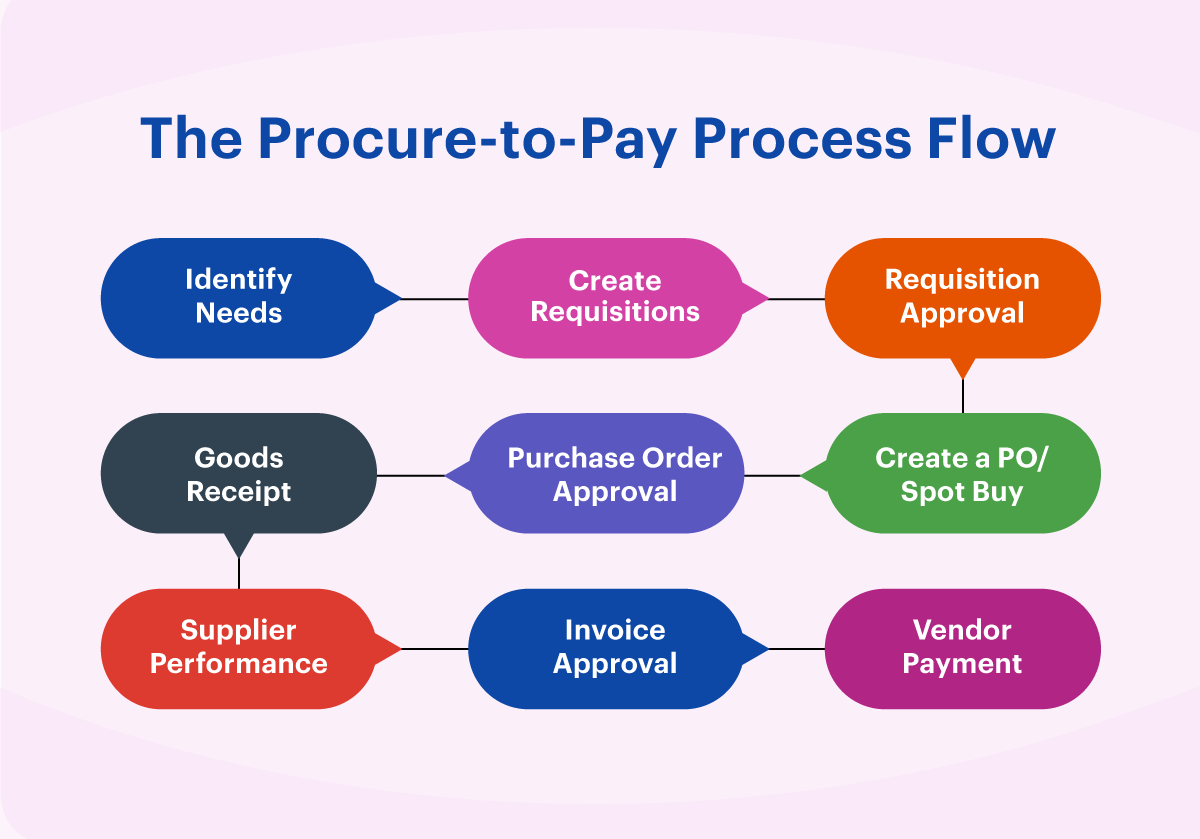

What is a procure-to-pay process?

The procure-to-pay process, also known as purchase-to-pay and P2P, refers to a series of steps that organizations follow to manage the acquisition of goods and services from external suppliers. The P2P process involves various stages, from identifying a need for goods or services and concluding with the payment to the suppliers. It is an essential business process that helps streamline procurement activities, control costs, and ensure efficient supplier management.

Based on organizational practice and the requirement in question, procurement leaders choose to complete the most relevant stages of a procure-to-pay process. This is where a tool like Kissflow Procurement Cloud comes in. You can customize your flow according to your business needs.

Streamline your procure-to-pay process with ease!

Choose Kissflow. Trusted by 1,000+ companies.

Procure-to-pay process Steps:

Step 1: Identify needs

The first step of a procure-to-pay process is to determine and define the business requirements with the help of cross-functional stakeholders. Once a valid need is identified, procurement teams sketch out high-level specifications for goods/products and terms of reference (TOR) for services, and statements of work (SOW).

Step 2: Create requisitions

After finalizing the specifications/TOR/SOW, a formal purchase requisition is created. A requester submits the filled-out purchase requisition form after ensuring that all necessary administrative requirements are met. Requisitions can be created for any type of procurement from standard purchases to subcontracts and consignments.

Step 3: Purchase requisition approval

Submitted purchase requisitions are then reviewed by department heads or procurement officers. Approvers can either approve or reject a purchase requisition after evaluating the need, verifying the available budget, and validating the purchase requisition form. Incomplete purchase requisitions are rejected back to the initiator for correction and resubmission.

Step 4: Create a PO/spot buy

If the requested goods/products have characteristics such as unmanaged category buys, one-time unique purchases, or low-value commodities, then a spot buy can be performed. Else, purchase orders are created from approved purchase requisitions.

Step 5: Purchase order approval

Purchase orders are now sent through an approval loop to ensure the legitimacy and accuracy of specifications. Approved purchase orders are then dispatched to vendors. After reviewing the purchase order vendors can either approve, reject, or start a negotiation. When an officer approves a purchase order, a legally binding contract is activated.

Cut down your P2P cycle processing time by 75%

Choose Kissflow. Trusted by 1,000+ companies.

Step 6: Goods receipt

Once the supplier delivers the promised goods/services, the buyer inspects the delivered products or services to ensure that it complies with the contract terms. The goods receipt is then approved or rejected based on the standards specified in the purchasing contract or purchase order.

Step 7: Supplier performance

Based on the data obtained from the previous step, the supplier performance is evaluated. A number of factors like quality, on-time delivery, service, contract compliance, responsiveness, and Total Cost of Ownership (TCO). Non-performance is flagged in existing rosters and information systems for future reference.

Step 8: Invoice approval

Once a goods receipt is approved, a three-way match between the purchase order, the vendor invoice, and the goods receipt is performed. If there are no discrepancies found, the invoice is approved and forwarded to the finance team for payment disbursement. In the case of inaccuracies, the invoice is rejected back to the vendor with a reason for rejection.

Step 9: Vendor payment

Upon receiving an approved invoice, the finance team will process payments according to the contract terms. Any contract changes or reviews of liquidated financial security will be taken into account. A payment made to a supplier will fall into one of the following five types: advance, partial, progress or installment, final, and holdback/retention payments.

Best practices in the procure-to-pay process

The following five P2P best practices can help organizations improve the efficiency and effectiveness of their procure-to-pay process:

- Implement procure-to-pay software

- Keep the process transparent

- Improve supplier engagement

- Optimize inventory

- Streamline contract management

How procure-to-pay software can bring efficiency to purchasing?

A recent Gartner report claims that by 2025, more than 50% of organizations around the world will have a cloud-based procure-to-pay suite in place. Cloud-based procurement tools like Kissflow Procurement Cloud are gaining traction, as organizations learn more about the benefits and cost-saving opportunities of using procurement software.

And, the following are some of the ways how you can bring efficiency in purchasing.

1. Purchase requisition and approvals

A digital procure-to-pay software routes the purchase request to all the stakeholders and approvers in the right order, eliminating email threads.

2. Purchase order management

Most procure-to-pay solutions auto-create purchase orders from approved purchase requisitions and initiate the PO dispatch process. Anything from sending multiple batch orders to a single vendor to creating multiple POs from a single PR can be done.

3. Digitalised vendor management

Going digital with vendor management changes the way your procurement team gauges and rates vendor performance. With a proper procure-to-pay tool, choosing the right vendor based on performance, pricing, discounts, delivery schedule adherence, and policy compliance is super easy!

4. Invoice matching

Procure-to-pay software like Kissflow Procurement Cloud lets organizations perform three-way matching to ensure a fool-proof purchase, approve invoices, manage exceptions, and integrate with electronic payments or account payable systems.

5. Insights into purchasing

One of the best things about automation is that reports and analysis help you understand what’s working and what’s not. It offers complete transparency into the process end-to-end. So you can pull up the status of any task instantly, analyze vendor performance metrics, and more through custom reports and analytics.

Recommended Reading:

- Top 6 Challenges in Procurement and How to Overcome Those

- How Manual Processes Are Killing Your Procurement Efforts

Unlock the full potential of your procure-to-pay process with Kissflow

Procure-to-pay solutions that digitally connect vendors, organizations, policies, and processes are unearthing new savings opportunities. From preventing manual data entry to improving spend visibility, automated procurement software address all existing process gaps.

By using a comprehensive procurement tool like Kissflow’s Procurement Cloud, you can leverage the power of workflows, digital forms, cloud tech, smart processes, and detailed analytics to help you derive more value out of the procure-to-pay process flow. It covers everything from purchase requests and orders all the way up to payment. It also integrates seamlessly with any accounting or ERP software you may be using, too.

With Kissflow, you can digitalize the entire P2P cycle, comprehensively improving all purchasing processes. Say hello to a digitized procure-to-pay process with Kissflow Procurement Cloud to find out why it is the best option to transform your procurement process.

Streamline your procure-to-pay process with ease!

Recommended Reading

Top 4 Procure to Pay Solutions Your Business Needs

In order to help you figure out which procure-to-pay software solutions are most suited to your business needs, we have put together this list of the top 4 procure-to-pay solutions that will drive efficiency in procurement management.

Procure-to-Pay (P2P) Automation: The Ultimate Guide

procure-to-pay automation, also called P2P automation, is the process of improving the efficiency of the procure-to-pay process by automating manual tasks and eliminating inconsistencies and delays.

11 Essential Procurement KPIs You Can’t Ignore

Procurement KPIs help an organization optimize and regulate spending, quality, time, and cost.