Easy Automation:

Innovate With Process Management Software

A simple and innovative way to build enterprise-grade processes

>

>

Welcome back,

It's a pleasure to reconnect with you! Check out this eBook for fresh perspectives to drive your digital transformation forward.

Take the Assessment

Structured for endless process evolution

Achieve and maintain process excellence with a wide range of benefits

Tailored

processes

Customize processes and ensure greater alignment with business goals and processes that fit like a glove

Enhanced

productivity

Reduce manual effort and errors by automating processes, enabling teams to focus on more strategic tasks

Cross-functional synergy

Foster teamwork across departments, break down silos, and promote cross-functional cooperation

Long-term adaptability

Ensure that the system remains aligned with the evolving needs of the business and maintains process excellence

You are just 3 steps away from process excellence

Create forms that capture accurate and relevant information to meet your unique requirement

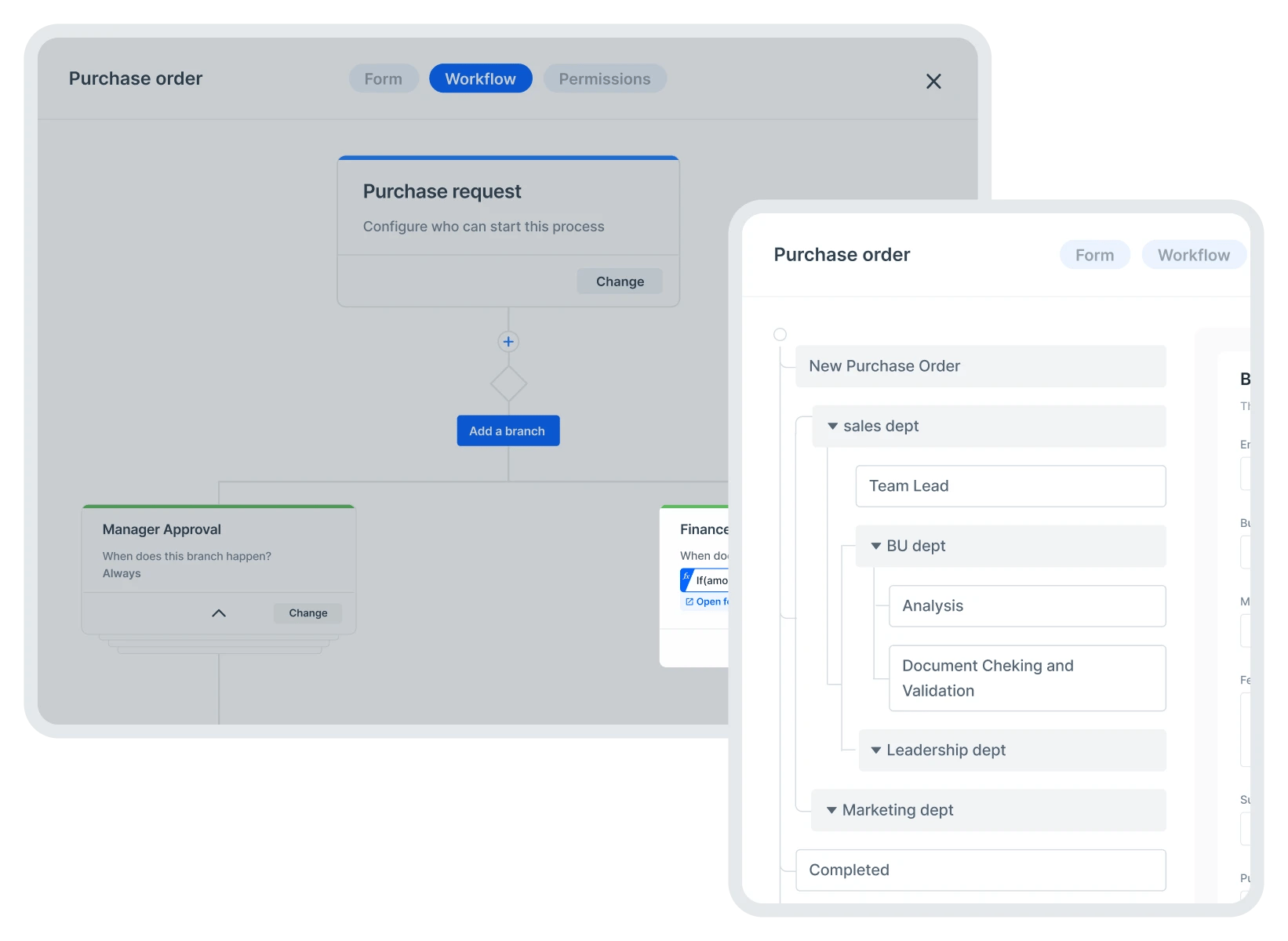

Accelerate decision-making with pre-defined workflows to keep your processes flowing seamlessly

Keep a comprehensive record of user actions with detailed accountability and audit trails

Create forms that capture accurate and relevant information to meet your unique requirement

Accelerate decision-making with pre-defined workflows to keep your processes flowing seamlessly

Keep a comprehensive record of user actions with detailed accountability and audit trails

Robust features that move your

processes forward

Simple to use

-

No coding necessary

Build, automate, and manage processes without code

-

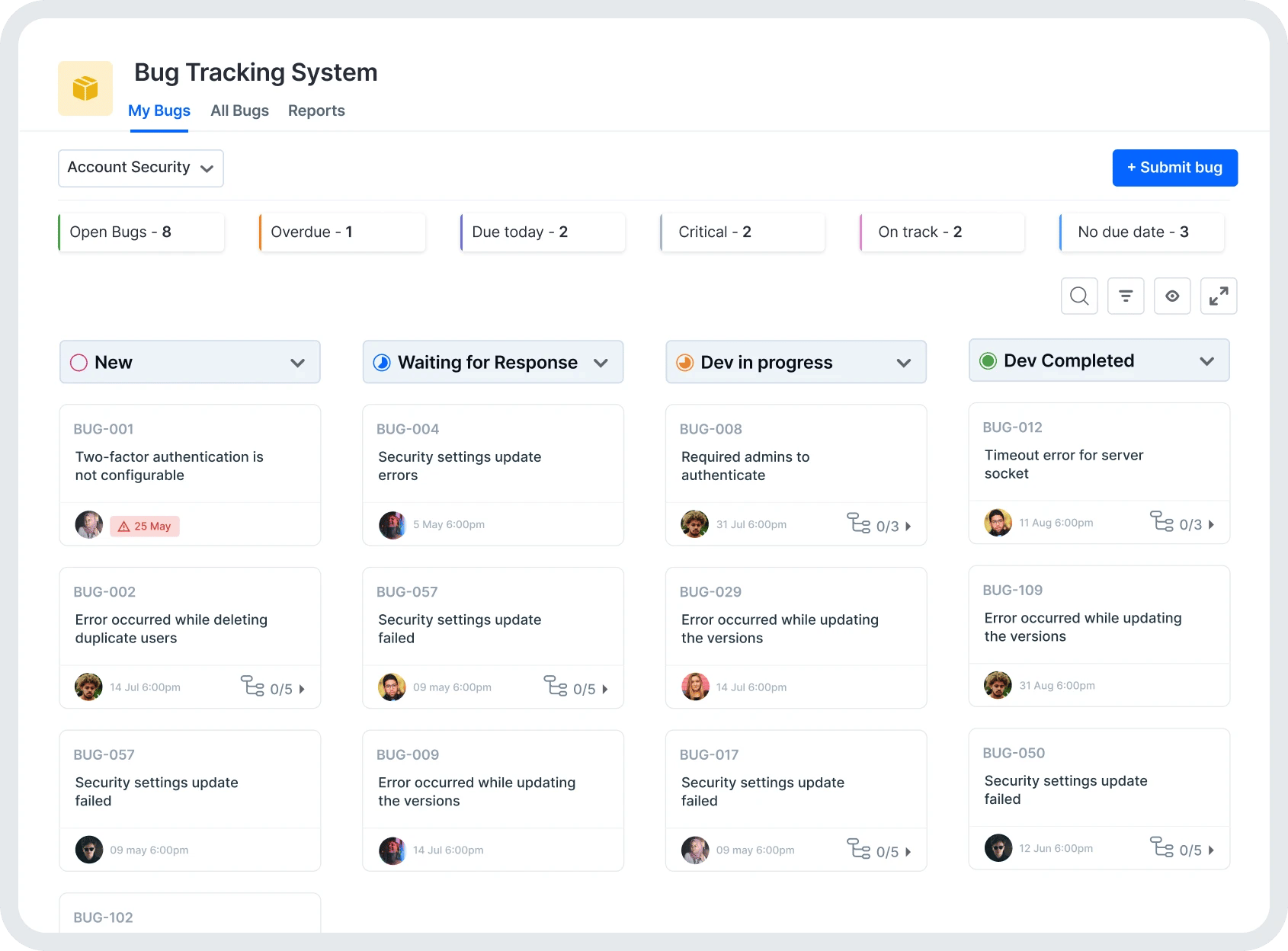

Smart Boards

Create freestyle workflows and projects on adaptable smartboards

Streamlined processes

-

Stay organized

Plan your processes, set priorities, and assign them to your team

-

Clutter-free

Get work completed and keep the process mess-free and on track

Unhindered flexibility

-

Fluid forms

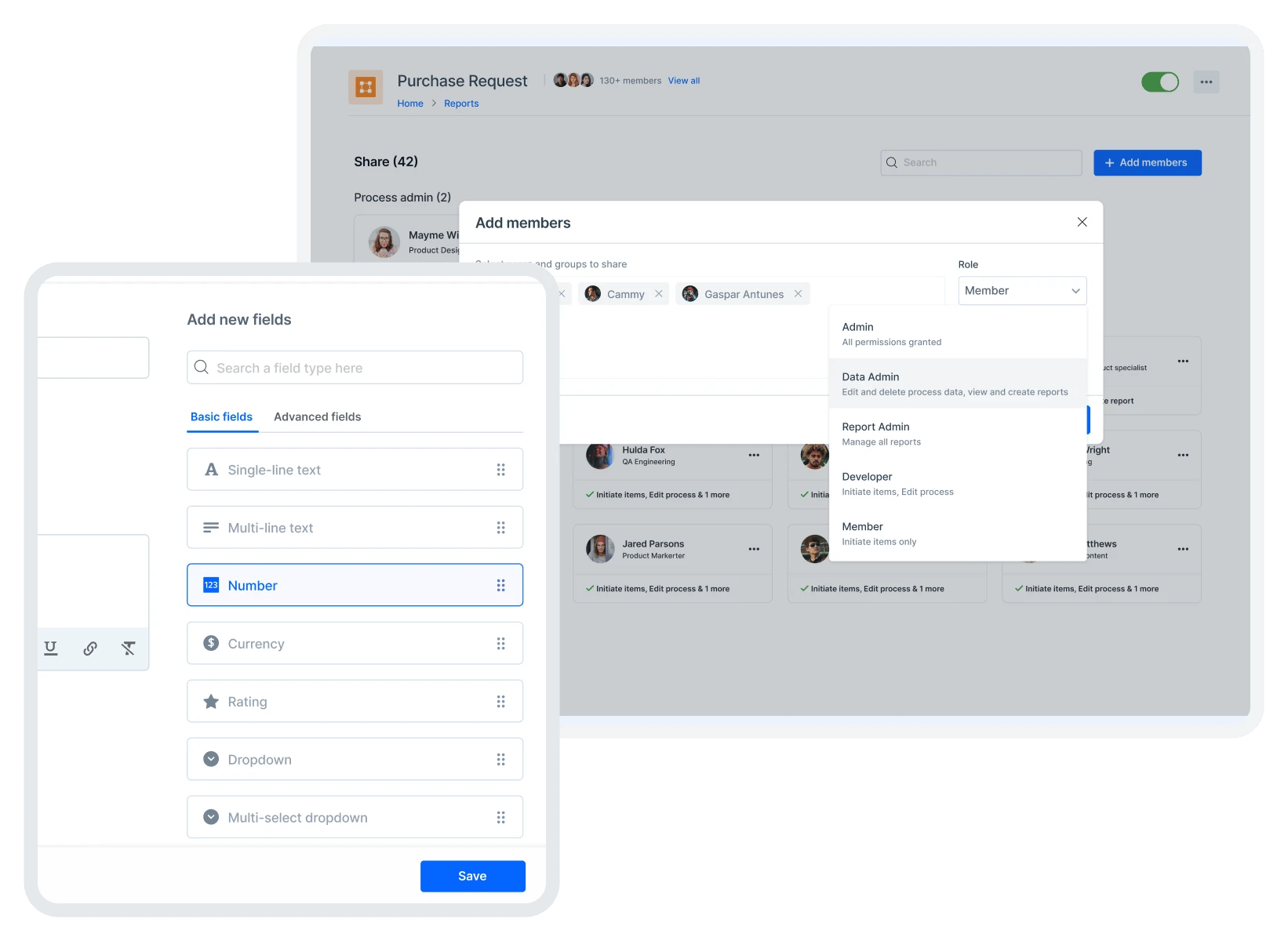

Design fully custom forms that fit any type of process requirements

-

Set permissions

Control who can start a process and what data users can see or edit at each step

Extensive connection

-

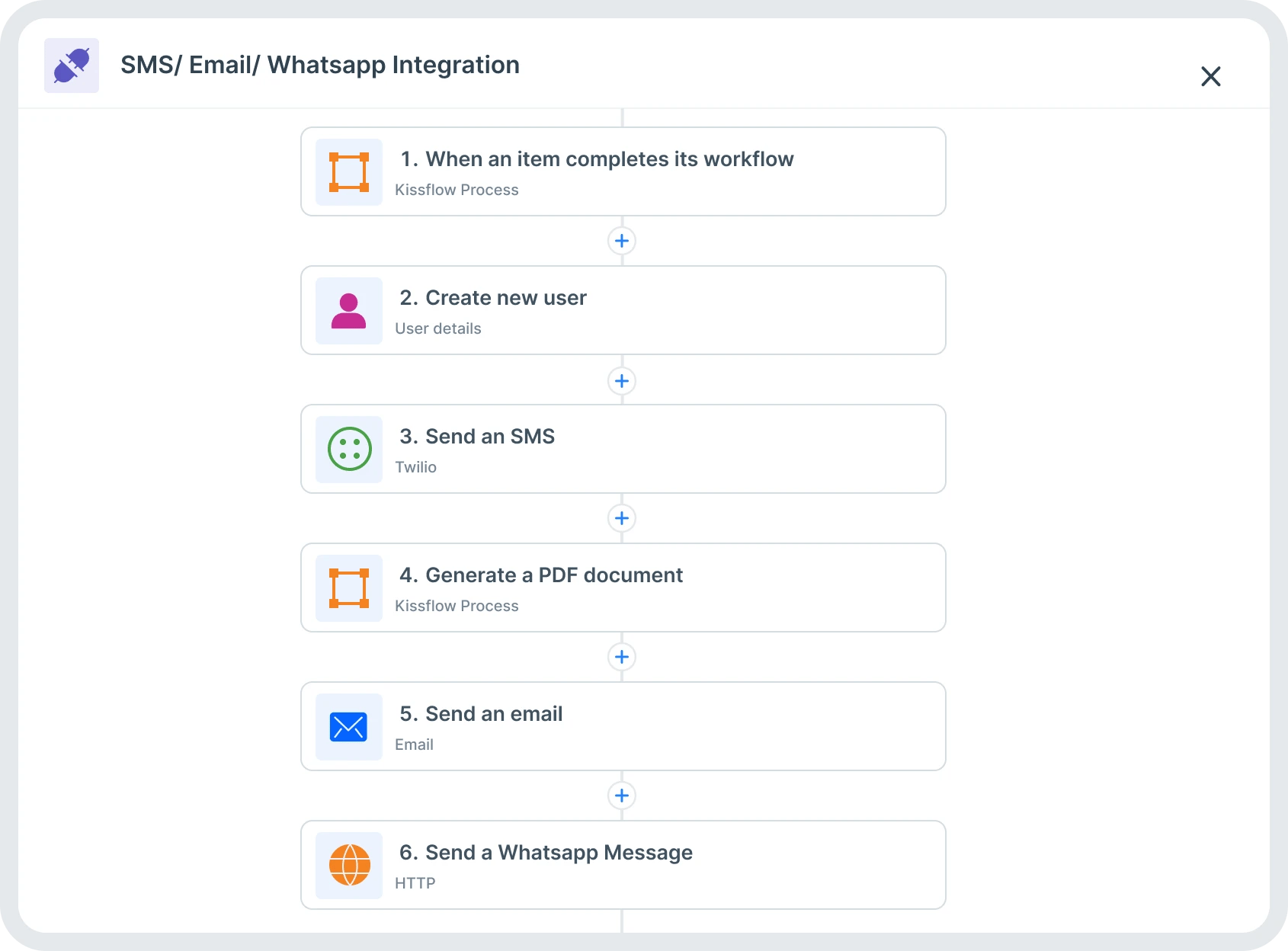

Integrate with zero code

Connect workflows across different processes to streamline complex, multi-step operations with zero code.

-

Seamless transition

Switch from structured to unstructured workflows without missing a beat.

All your workflows on a single platform

Explore Appstore >

- Employee Onboarding

- IT Incident Management

- Lead Qualification

- Travel request

- Compliant Management

- Contract Renewal

- CAPEX Request

- RFP Approval

- Corporate Card Request

- Accounts Receivable

- Admin Service Request

- Budget Transfer

- Compliant Management

- Customer HelpDesk

- Performance Appraisal

- Access Requests

- Employee Expense Claim

- Performance Bonus

All your apps on a single platform

Explore Appstore >- Employee Onboarding

- IT Incident Management

- Lead Qualification

- Travel request

- Compliant Management

- Contract Renewal

CAPEX RequestRFP ApprovalCorporate Card RequestAccounts ReceivableAdmin Service RequestBudget Transfer

- Compliant Management

- Customer HelpDesk

- Performance Appraisal

- Access Requests

- Employee Expense Claim

- Performance Bonus

Talk to our experts

Sign up for Kissflow today and unlock the power of custom processes

-

Learn to build custom processes that fit your needs

-

Get the most out of ready-to-deploy templates

-

Schedule a demo and see the Kissflow in action

By proceeding, you agree to our Terms of Service and Privacy Policy

Thank you for your interest in exploring Kissflow. Our solution experts will get in touch with you within one business day.

The voice of our satisfied customers

"This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.' "

Renee Villarreal

McDermott

"I designed it, tested it, and had it ready in a week. The platform is simple and highly intuitive, so anyone can use it."

Ajit Singh

Caratlane

"Kissflow's integration with Snowflake and Tableau has saved time, improved data quality, and automated our business processes. This has resulted in increased productivity and operational efficiency.”

Eduardo Meza

Motorola Solutions