Simple Automation

with Process Management Tools

A simple and innovative way to build enterprise-grade processes

Trusted by global brands

Structured for endless process evolution

Achieve and maintain process excellence with a wide range of benefits

Tailored processes

Customize processes and ensure greater alignment with business goals and processes that fit like a glove

Enhanced productivity

Reduce manual effort and errors by automating processes, enabling teams to focus on more strategic tasks

Cross-functional synergy

Foster teamwork across departments, break down silos, and promote cross-functional cooperation

Long-term adaptability

Ensure that the system remains aligned with the evolving needs of the business and maintains process excellence

You are just 3 steps away from process excellence

Create forms that capture accurate and relevant information to meet your unique requirement

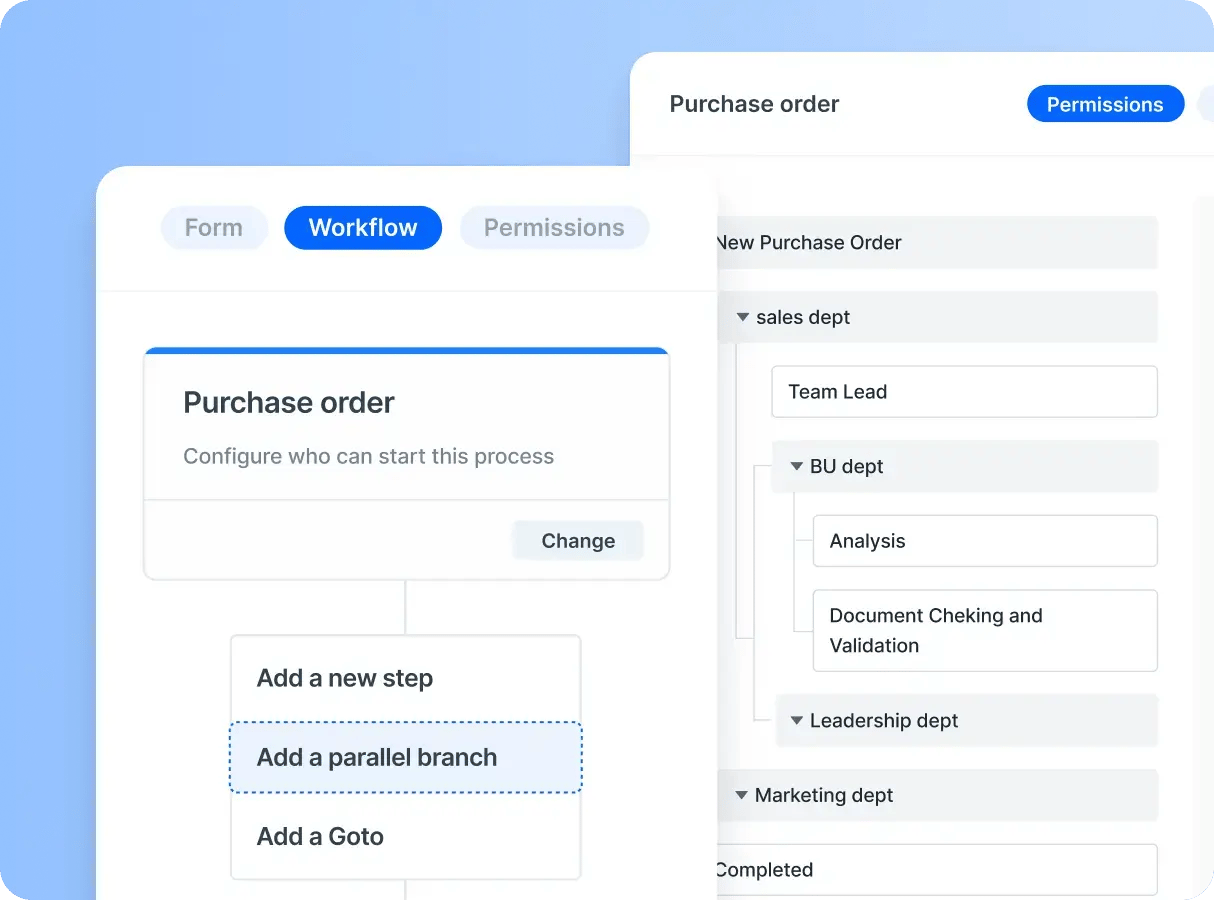

Accelerate decision-making with pre-defined workflows to keep your processes flowing seamlessly

Keep a comprehensive record of user actions with detailed accountability and audit trails

Create forms that capture accurate and relevant information to meet your unique requirement

Accelerate decision-making with pre-defined workflows to keep your processes flowing seamlessly

Keep a comprehensive record of user actions with detailed accountability and audit trails

Robust features that move

your processes forward

Simple to use

-

No coding necessary

Build, automate, and manage processes without code -

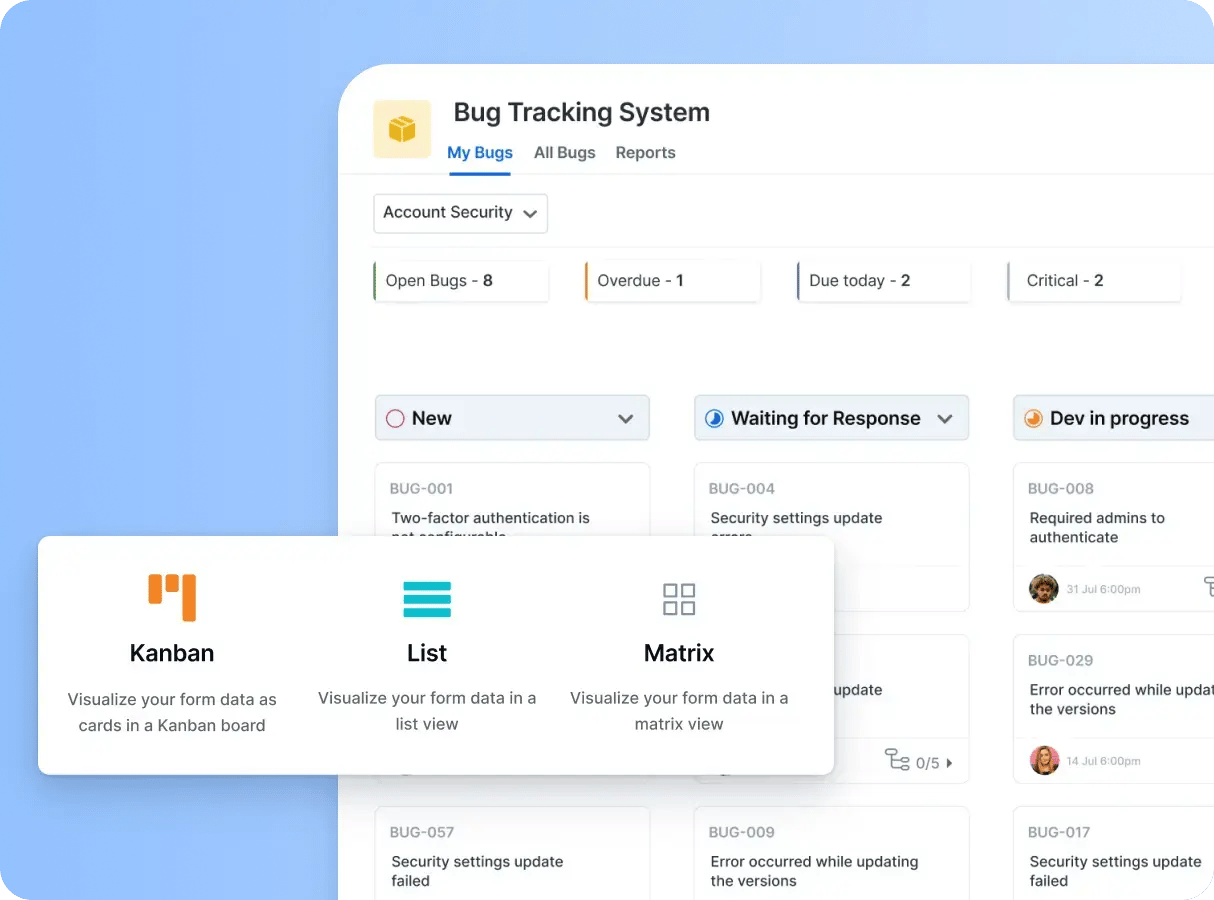

Smart Boards

Create freestyle workflows and projects on adaptable smartboards

Streamlined processes

-

Plan your processes, set priorities, and assign them to your team

-

Get work completed and keep the process mess-free and on track

Unhindered flexibility

-

Design fully custom forms that fit any type of process requirements

-

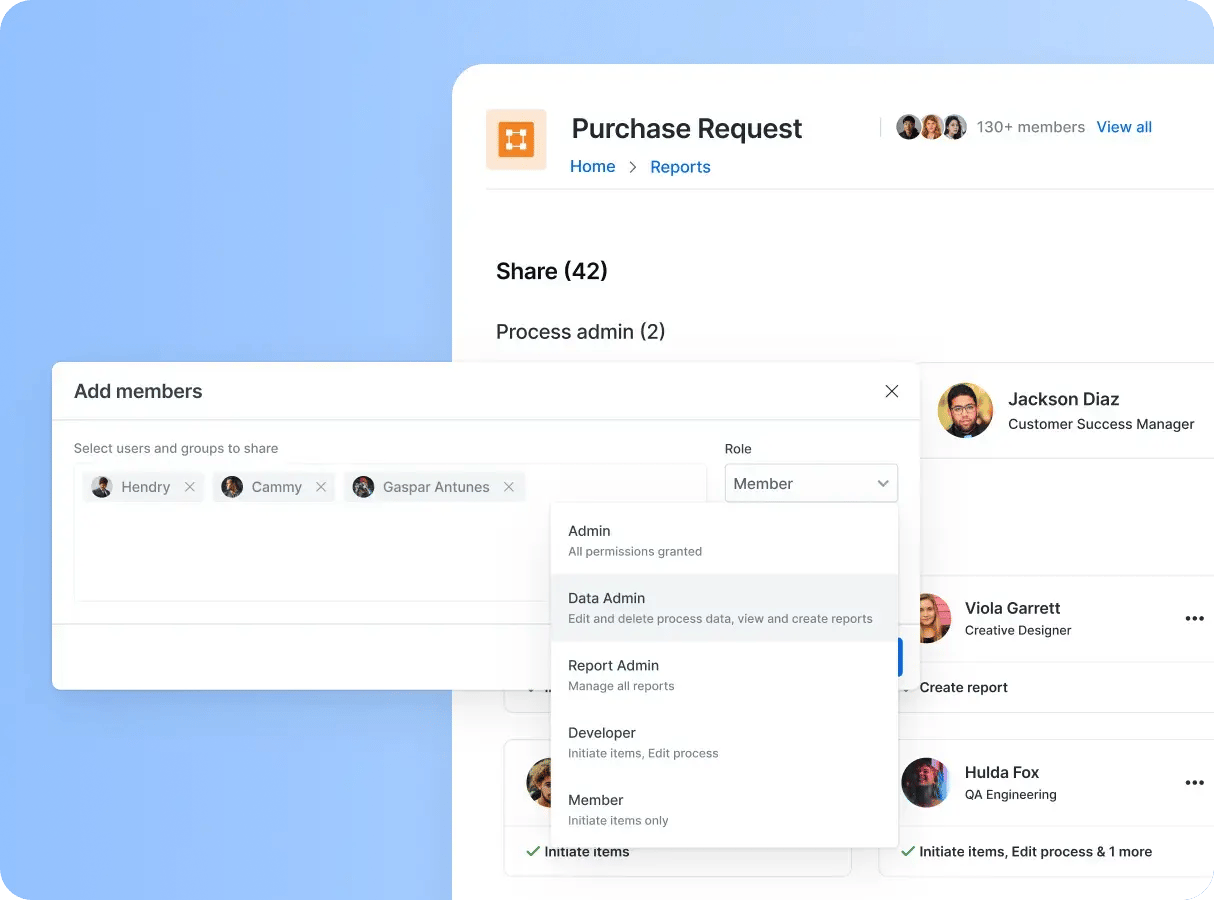

Control who can start a process and what data users can see or edit at each step

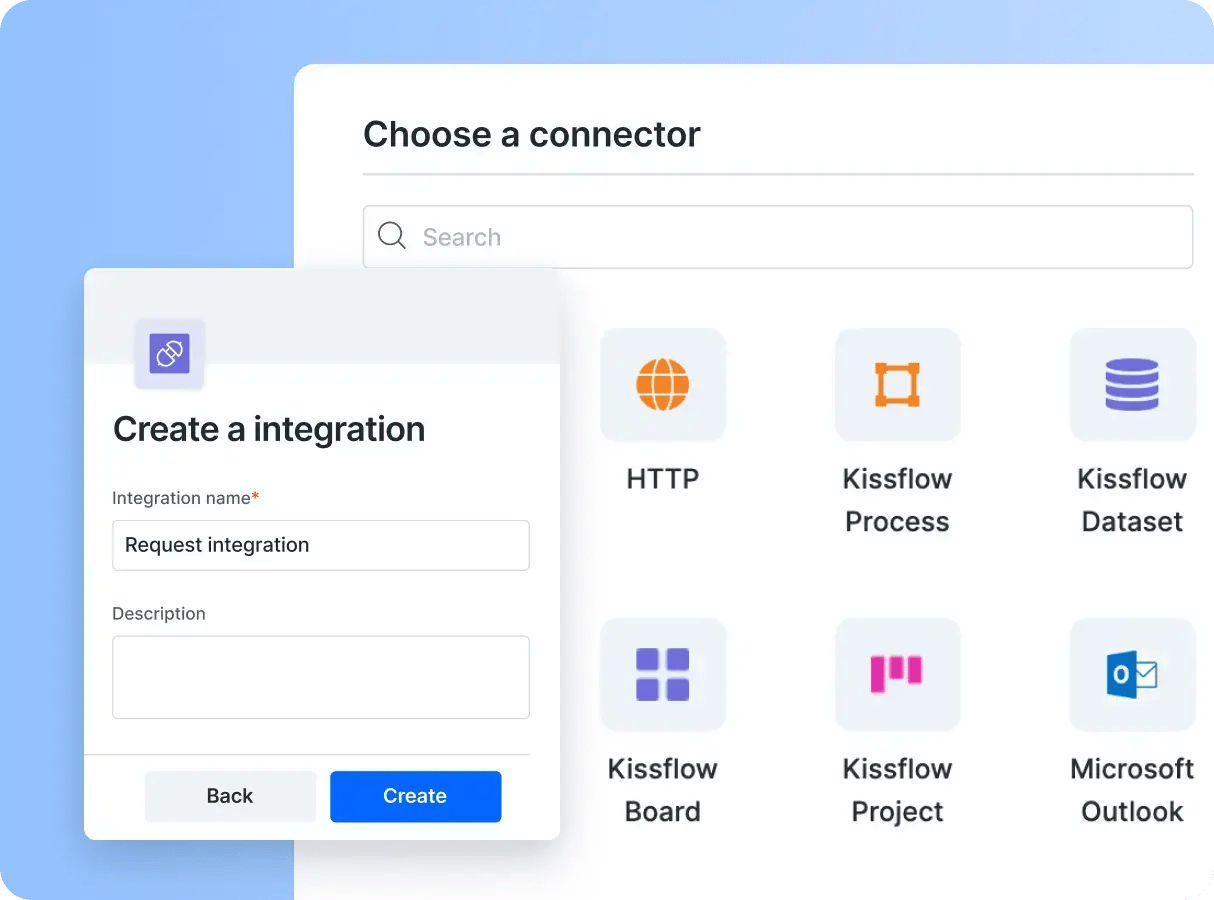

Extensive connection

-

Connect workflows across different processes to streamline complex, multi-step operations with zero code.

-

Switch from structured to unstructured workflows without missing a beat.

All your workflows on a single platform

Explore Appstore >

- Employee Onboarding

- IT Incident Management

- Lead Qualification

- Travel request

- Compliant Management

- Contract Renewal

- CAPEX Request

- RFP Approval

- Corporate Card Request

- Accounts Receivable

- Admin Service Request

- Budget Transfer

- Compliant Management

- Customer HelpDesk

- Performance Appraisal

- Access Requests

- Employee Expense Claim

- Performance Bonus

See how Kissflow is built for

IT Leaders

IT Leaders

IT Leaders

Process Owners

Process Owners

Process Owners

Business Users

Business Users

Business Users

All your apps on a single platform

Explore The App Store >- Budget Approval

- Expense Management

- Payables and Receivables

- Treasury Requests

- Capital Expenditure

Travel Reimbursement Admin Service Requests Record keeping Maintenance Scheduling IT Service Requests

- Leave Management

- Performance Management

- Employee Management

- Department Transfers

- HR Benefits Requests

Here's what our customers say

Discover real-world success stories that showcase how Kissflow drives results and empower businesses to thrive.

We seek to go beyond incremental efforts not only in sustainability but also in everything we do. With Kissflow, FPH and its subsidiaries were able to digitize dramatically major operations, especially in their finance and accounts operations.

Joseph Arnel Chavez

Assistant Manager

Industry

Energy & Utilities

HeadQuaters

Philippines

Key Highlights

100+

Office Processes Automated

1,000+

Monthly Paperless Processes

10,000+

Employees

This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.

Renee Villarreal

Senior IT Manager

Industry

Energy

HeadQuaters

USA

Key Highlights

450+

Process

10x

ROI

10,000+

Users

The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes.

Oliver Umehara

IT Manager

Industry

Telecom & Media

HeadQuaters

Japan

Key Highlights

28+

Processes

42

Group Companies

70+

Users

Don’t take our word for it

Market Leaders in the G2 Grid for 2024

Frequently Asked Questions

Yes, Kissflow is designed for both technical and non-technical users. Its intuitive drag-and-drop interface and pre-built templates make it easy for business users to create and manage workflows, while IT teams can use advanced features for customization and integrations.

Kissflow offers integration capabilities with a wide range of popular applications, including CRM systems like Salesforce, project management tools like Asana, communication platforms like Slack, and many more. Whether you're looking to streamline sales processes, manage projects more effectively, or enhance collaboration across teams, Kissflow provides the flexibility to integrate with the tools you already use and love.

Kissflow offers robust security features, including role-based access controls, audit logs, and compliance with industry standards. This ensures that sensitive data remains secure and accessible only to authorized users.

Kissflow is versatile and supports various workflows, including approval processes, employee onboarding, purchase requests, IT ticketing, and more. It can be customized to meet the unique needs of any department or organization.