Build App Faster With

Kissflow's Pre-Built Low-Code Apps

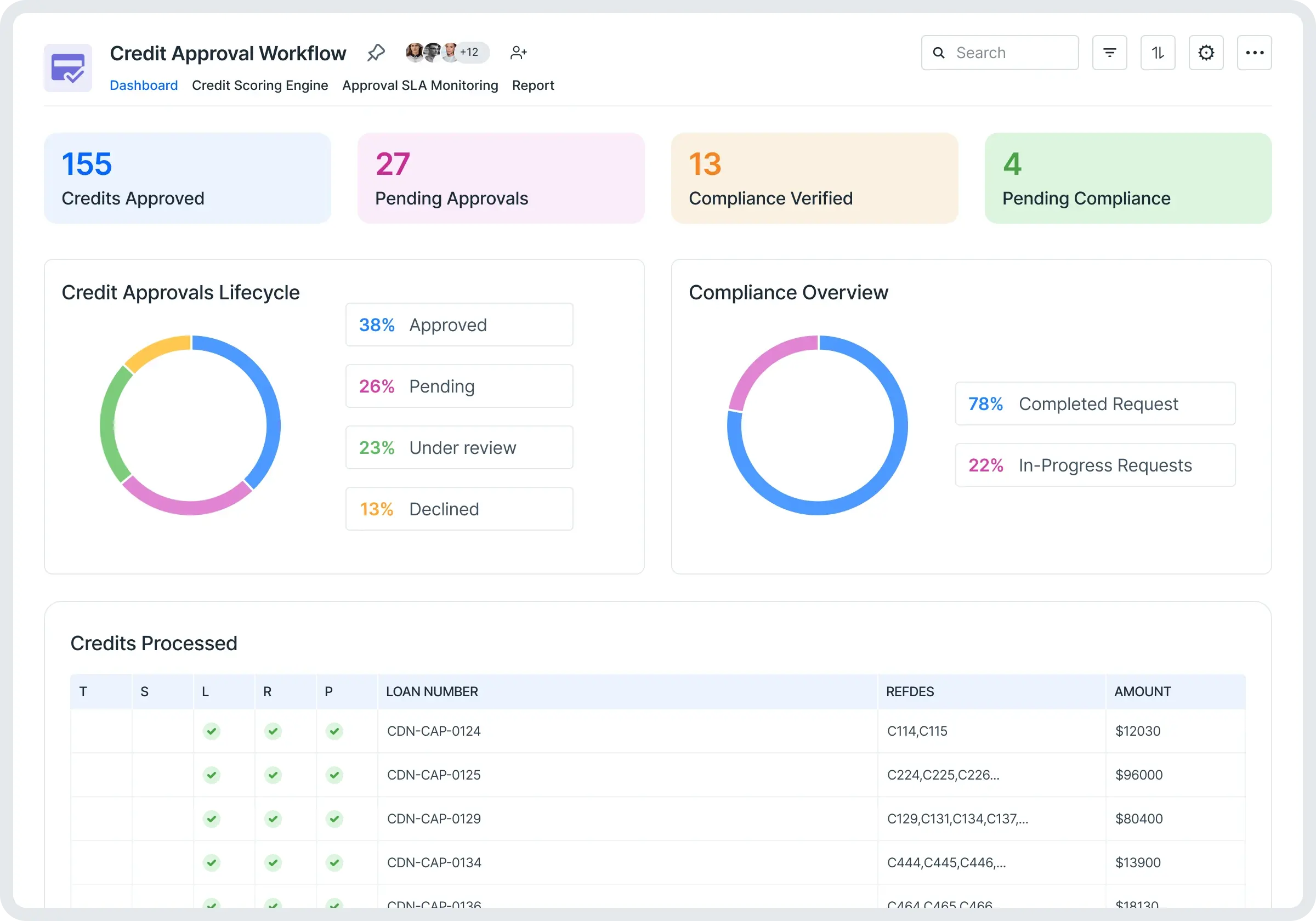

Building enterprise-grade low-code applications with Kissflow requires minimal ramp-up time, enabling IT teams and business units to collaborate without bottlenecks. Kissflow’s visual development environment empowers process owners to rapidly design and deploy both simple and mission-critical applications—while IT retains full governance and security oversight.

Enterprises can also deploy fully functional, pre-built low-code apps to accelerate modernization, automate complex workflows, and standardize operations across departments. With reusable components, built-in compliance controls, and seamless integration capabilities, Kissflow helps organizations streamline internal processes at scale—without rebuilding systems from scratch.

Risk-Based Approval Routing

Kissflow's Multi-Level Approval Workflow App allows finance and credit teams to create tiered, rule-based approval hierarchies for customer credit requestsensuring the right people review high-value or high-risk decisions, and no step is missed.

Creator

Language

English

Category

Retail

Trusted by credit ops and B2B finance teams to improve risk control, reduce overload on senior reviewers, and streamline tiered approvals.

What Is a Risk-Based Approval Routing App?

It's a workflow routing engine that applies logic based on scoring results or application data to determine the correct approvers. It ensures that higher-risk cases get escalated, while low-risk cases are fast-tracked through the process.

It ensures:

- High-risk cases are reviewed by senior staff

- Low-risk approvals aren't delayed by unnecessary reviews

- Approval paths are consistent and defensible

- The right routing logic is enforced across all teams

Why Do Credit Teams Need This?

Without risk-based routing, teams experience:

- Overloaded senior approvers with basic low-risk cases

- Delays due to unclear routing responsibilities

- Inconsistent approval paths by region or manager

- Poor auditability of who approved what and why

Key Benefits:

- Automate credit application routing by score or criteria

- Reduce approval bottlenecks for low-risk customers

- Improve consistency and compliance in credit decisions

- Free up senior team members for complex approvals

Route Smartly With Low-Code Approval Logic

With Kissflow's low-code routing builder, you can set conditional workflows like "If score >700, auto-approve" or "If credit request >$100K and risk = high, route to VP Finance." Configure chains by geography, business unit, score, or product type.

Multiple routing templates can be created and reused across different customer segments or approval tiers.

Why Choose a Routing App Built on Low-Code?

- Define dynamic routing logic by score, value, or region

- Auto-escalate approvals based on complexity

- Maintain visual logs of routing paths per application

- Update approval roles and paths in minutes

Who Is This For?

- Credit operations teams processing high volumes

- Regional and global finance organizations

- B2B distributors managing tiered customer types

- Legal or compliance teams monitoring approvals

Digitize Your Retail Processes, Fast

Modules

-

Approval Routing Engine: Build rule-based routing logic

-

Risk Category Mapper: Assign risk levels using credit score or profile

-

Escalation Workflow Manager: Handle exceptions and overdue approvals

-

Role-Based Approval Templates: Apply routes per product, value, or team

-

Routing History Log: View who handled which step, when

Features

-

Score- and value-based approval path logic

-

Multi-region, multi-tier routing capabilities

-

SLA timers and escalation triggers

-

Real-time routing visualization

-

Approval audit logs and approver role mapping

-

Auto-routing for low-risk, low-limit accounts

-

Low-code customization of all routing logic

-

Click the Enquire button on the app tile or landing page.

-

Fill in the details of the features you want and your team's size on the enquiry form.

-

Click Submit.

Kissflow's support team will contact you to learn more about your requirements.

Fast for the Safe. Thorough for the Risky.

Finance teams are reducing cycle times and improving risk governance with Kissflow's Risk-Based Approval Routing App.

This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.

Renee Villarreal

Senior IT Manager

Industry

Energy

HeadQuaters

USA

Key Highlights

450+

Process

10x

ROI

10,000+

Users

The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes.

Oliver Umehara

IT Manager

Industry

Telecom & Media

HeadQuaters

Japan

Key Highlights

28+

Processes

42

Group Companies

70+

Users

We seek to go beyond incremental efforts not only in sustainability but also in everything we do. With Kissflow, FPH and its subsidiaries were able to digitize dramatically major operations, especially in their finance and accounts operations.

Joseph Arnel Chavez

Assistant Manager

Industry

Energy & Utilities

HeadQuaters

Philippines

Key Highlights

100+

Office Processes Automated

1,000+

Monthly Paperless Processes

10,000+

Employees

Frequently Asked Questions

Explore other related apps

Purchasing and Inventory Management App

By Kissflow

Optimize your retail operations with streamlined purchasing processes and real-time inventory control

Custom Quote

Warehouse Management App

By Kissflow

See our warehouse management app in action

Custom Quote

Accelerate and scale app development with Kissflow

Customize with pre-built templates

Build custom low-code apps quickly with pre-built templates.

Tackle internal app backlogs

Implement strategies to clear your internal application backlog quickly.

Join enterprises that trust Kissflow

Enterprises use our low-code platform to streamline app development.

Didn’t find what you're looking for?

Let us know what we can build for you