Build App Faster With

Kissflow's Pre-Built Low-Code Apps

Building enterprise-grade low-code applications with Kissflow requires minimal ramp-up time, enabling IT teams and business units to collaborate without bottlenecks. Kissflow’s visual development environment empowers process owners to rapidly design and deploy both simple and mission-critical applications—while IT retains full governance and security oversight.

Enterprises can also deploy fully functional, pre-built low-code apps to accelerate modernization, automate complex workflows, and standardize operations across departments. With reusable components, built-in compliance controls, and seamless integration capabilities, Kissflow helps organizations streamline internal processes at scale—without rebuilding systems from scratch.

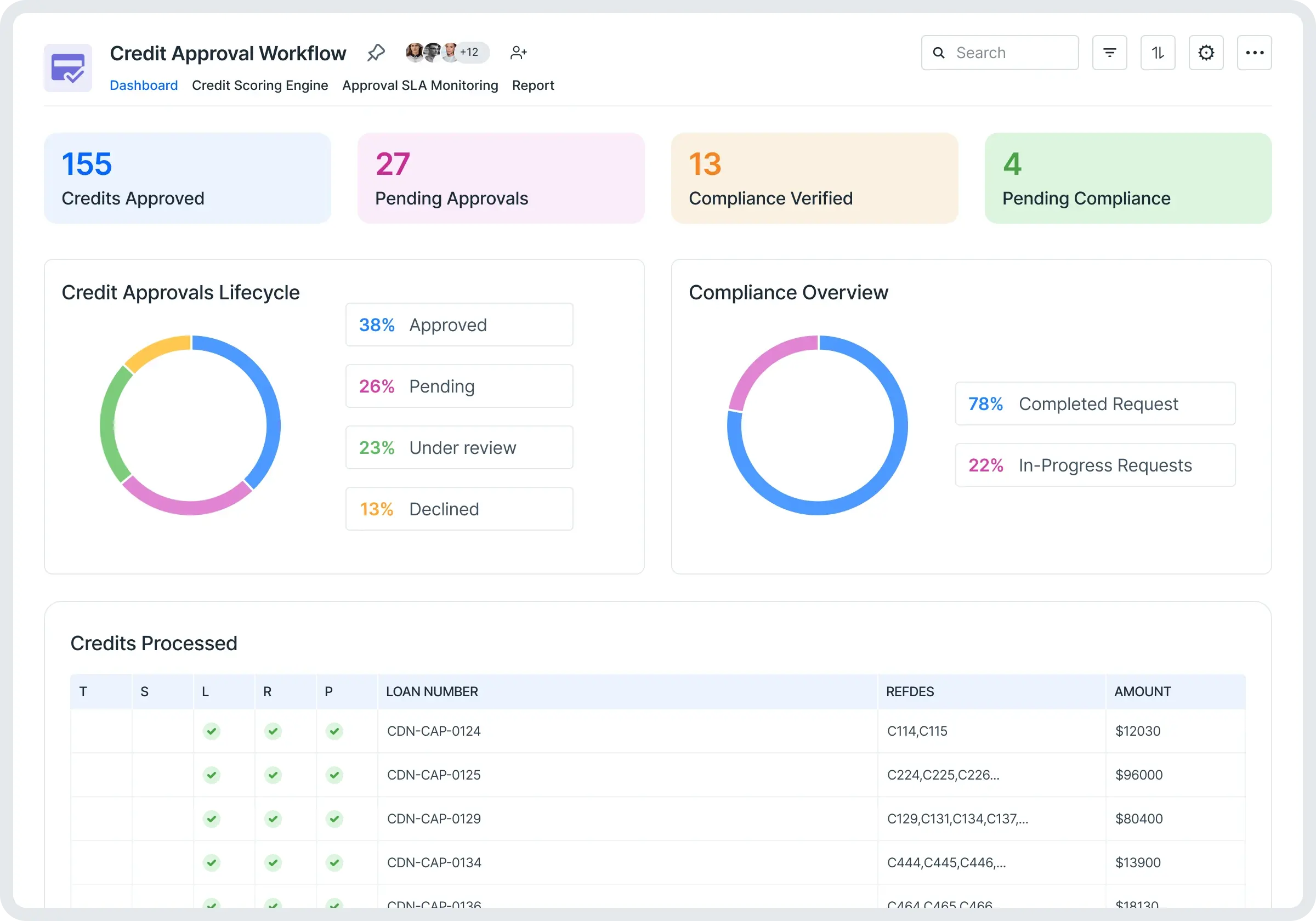

Credit Limit Management

Kissflow's Compliance & Document Verification App automates the collection, validation, and approval of all required credit-related documents. Ensure customers meet internal and external compliance standards without chasing paperwork.

Creator

Language

English

Category

Retail

Trusted by enterprise credit departments and B2B finance teams to enforce approval policies, automate routing, and reduce manual tracking.

What Is a Credit Limit Management App?

It's a control system that defines the maximum allowable credit for customers based on scoring, financials, historical behavior, and business rules. You can auto-assign limits or push them for approval based on request type or changes in credit health.

It ensures:

- Clear spending boundaries for each account

- Risk-aligned exposure management

- Rule-based assignments and exception handling

- Full visibility into limit history and revisions

Why Do Finance Teams Need This?

Without centralized limit management, teams face:

- Uncontrolled exposure and credit policy violations

- Manual tracking of approvals and exceptions

- Difficulty updating limits as customer profiles change

- Poor alignment with credit risk recommendations

Key Benefits:

- Define and auto-assign limits based on rules

- Push over-limit requests into approval workflows

- View and adjust limits with full justification history

- Align limits with real-time risk and payment data

Govern Credit Limits With Low-Code Rules and Workflows

Using Kissflow's low-code builder, you can define credit assignment rules like "Auto-limit = 20% of last 12 months' revenue," or "Limit capped at 2x outstanding balance." Customize workflows for limit increases, set review intervals, and link to compliance alerts.

Approval chains for exception handling are also configurable, with reminders and audit logs.

Why Choose a Limit App Built on Low-Code?

- Align credit limits to evolving business criteria

- Auto-adjust or trigger reviews based on behavior or score

- Visualize exposure vs. limit at account level

- Modify rules, formulas, and workflows as needed

Who Is This For?

- Finance controllers managing customer credit risk

- Credit ops teams issuing limits at scale

- Sales finance leads requesting limit changes

- Compliance teams ensuring policy adherence

Optimize Retail Operations Through Automation

Modules

-

Limit Assignment Engine: Apply initial limits using defined formulas

-

Limit Review Workflow: Approve increase, decrease, or freeze requests

-

Limit Exception Tracker: Flag and process special cases

-

Exposure Monitor: Compare usage to available credit

-

Audit Trail of Revisions: Track who changed what, and why

Features

-

Auto-assignment of credit limits by rules

-

Manual override with approval tracking

-

Limit increase/decrease requests

-

Alerts for nearing or exceeding limits

-

Role-based limit editing permissions

-

Version history of all limit changes

- Low-code rules for limit criteria and logic

-

Click the Enquire button on the app tile or landing page.

-

Fill in the details of the features you want and your team's size on the enquiry form.

-

Click Submit.

Kissflow's support team will contact you to learn more about your requirements.

Credit Limits That Are Smarter, Safer, and Scalable

Companies are reducing exposure risk with Kissflow's Credit Limit Management App.

This is so easy, even my mom could do this. It was extremely intuitive and straightforward. The watermark was, 'I don't need to call IT to do this. I can do it myself.

Renee Villarreal

Senior IT Manager

Industry

Energy

HeadQuaters

USA

Key Highlights

450+

Process

10x

ROI

10,000+

Users

The beauty of Kissflow is how quick and easy it is to create the apps I need. It's so user-friendly that I made exactly what I needed in 30 minutes.

Oliver Umehara

IT Manager

Industry

Telecom & Media

HeadQuaters

Japan

Key Highlights

28+

Processes

42

Group Companies

70+

Users

We seek to go beyond incremental efforts not only in sustainability but also in everything we do. With Kissflow, FPH and its subsidiaries were able to digitize dramatically major operations, especially in their finance and accounts operations.

Joseph Arnel Chavez

Assistant Manager

Industry

Energy & Utilities

HeadQuaters

Philippines

Key Highlights

100+

Office Processes Automated

1,000+

Monthly Paperless Processes

10,000+

Employees

Frequently Asked Questions

Explore other related apps

Purchasing and Inventory Management App

By Kissflow

Optimize your retail operations with streamlined purchasing processes and real-time inventory control

Custom Quote

Warehouse Management App

By Kissflow

See our warehouse management app in action

Custom Quote

Accelerate and scale app development with Kissflow

Customize with pre-built templates

Build custom low-code apps quickly with pre-built templates.

Tackle internal app backlogs

Implement strategies to clear your internal application backlog quickly.

Join enterprises that trust Kissflow

Enterprises use our low-code platform to streamline app development.

Didn’t find what you're looking for?

Let us know what we can build for you