- All Templates

- Human Resource

- Employee Loan Request

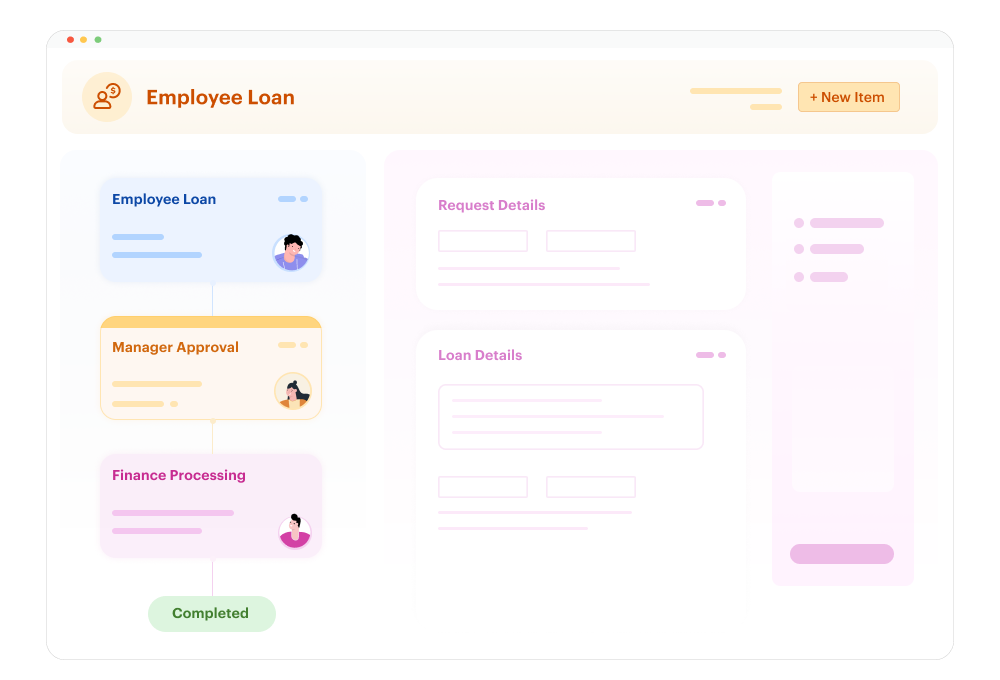

Employee Loan Request

Supporting your employees during tough times builds loyalty. This employee loan approval template makes cash advance workflow simple and transparent, from request to repayment. Kissflow's AI-powered low-code platform handles all the financial controls automatically so you can focus on helping your team.

Use TemplateWhat you'll do:

Build an automated employee loan management system with intelligent validation, repayment tracking, and seamless approval routing for employee financial assistance.

How long you need:

Around 10 minutes to set up and customize

What you'll need:

-

A Kissflow account

-

Your employee loan policies and eligibility criteria

-

Approval hierarchies and loan limits by employee grade

-

Payroll system details for integration (optional)

About The Employee Cash Loan Request Template

Managing employee cash loans manually can lead to policy inconsistencies, repayment tracking errors, and delayed approvals. This AI-powered template ensures every loan request follows approval protocols, validates eligibility automatically, and maintains complete repayment records—all without manual intervention.

Kissflow's intelligent workflow automation monitors repayment schedules and automatically coordinates with payroll for seamless deductions across your workforce.

With Kissflow's AI-powered low-code platform, HR and finance teams can deploy a fully functional employee loan system in minutes:

-

Instant setup with pre-configured loan types (emergency loans, salary advances, personal loans, educational loans)

-

Drag-and-drop customization to match your organization's loan policies and approval hierarchies

-

AI-assisted validation that automatically checks eligibility, outstanding loans, and repayment capacity

-

Role-based security with confidential handling of employee financial information

-

Smart routing that directs requests to appropriate approvers based on loan amount and employee grade

-

Automated notifications to keep employees informed and finance teams coordinated with payroll

-

Mobile-ready interface for submitting loan requests and tracking repayment status on-the-go

Getting Started With The Employee Cash Loan Request Template

Use this TemplateBenefits of Using This Template

🤖 AI-Powered Intelligence

Leverage Kissflow's AI capabilities to predict repayment capacity, identify employees at risk of default, automate approval decisions for routine requests, and optimize loan policy parameters.

☁️ Scalable Cloud Infrastructure

Handle loan requests from hundreds to thousands of employees with a secure, cloud-based platform that scales across multiple locations and business units.

👁️ Complete Process Visibility

Track every loan request from application through final repayment with real-time status updates, comprehensive repayment schedules, and complete audit trails for compliance.

⚡ Low-Code Simplicity

Empower HR teams to modify loan policies, adjust eligibility criteria, or update repayment terms using Kissflow's intuitive interface—reducing IT dependency and enabling rapid policy updates.

🔄 Seamless Collaboration

Enable managers to approve requests, finance teams to disburse funds, payroll to coordinate deductions, and HR to maintain employee welfare programs—all within one integrated workflow.

📊 Actionable Analytics & Insights

Generate comprehensive reports on loan utilization patterns, repayment performance, program costs, employee participation rates, and policy effectiveness to optimize employee assistance programs.

🔒 Enterprise-Grade Security

Ensure financial data protection with SOC 2, GDPR compliance, encryption, and role-based access controls meeting stringent privacy and security requirements.

Built using these capabilities:

AI-Powered Workflow Automation Intelligent eligibility validation automatically checks tenure, outstanding balances, and repayment capacity before routing for approval

Low-Code Form Builder Create custom loan application forms without coding—capturing loan purpose, repayment preferences, and supporting documentation

Real-Time Analytics Dashboard Track loan utilization, outstanding balances, repayment performance, and default risks across departments

Integration Hub Connect seamlessly with payroll systems, accounting platforms, banking systems, and HRMS for automated repayment processing

How to Get Started

-

Sign up for a Kissflow account or log into your existing workspace

-

Select the Employee Cash Loan Request template from the HR or finance category

-

Customize loan types, eligibility criteria, and multi-level approval hierarchies using the visual editor

-

Configure AI-powered validation rules and automated repayment tracking

-

Test the workflow with sample loan requests across different employee grades and amounts

-

Deploy organization-wide with a single click—no coding or extensive IT support needed

-

Scale effortlessly as your workforce and loan program grows

Employee loan requests require confidentiality and clear approval trails. No-code software allows HR and finance teams to manage these requests securely.

Frequently Asked Questions

Do I need coding experience to set up this template?

No! Kissflow's low-code platform is designed for business users. You can customize workflows, forms, and approval rules using an intuitive drag-and-drop interface without writing any code.

Can I customize loan policies and eligibility?

Absolutely. The template comes with standard policies, but you can easily configure loan limits by employee grade, tenure requirements, maximum outstanding loan limits, repayment terms, interest rates, or any custom policies specific to your organization.

How does the AI-powered workflow automation work?

Kissflow's AI automatically validates loan requests against your policies, checks for outstanding loans, assesses repayment capacity based on salary and existing deductions, and routes requests to appropriate approvers—tracking repayment schedules automatically.

Can this template handle complex approval hierarchies?

Yes. You can configure multi-level approvals based on loan amounts, conditional routing for exceptional cases, parallel approvals from managers and finance, and executive approval requirements for high-value loans.

Will this integrate with our payroll system?

Kissflow offers seamless integration with popular payroll platforms (ADP, Workday, SAP SuccessFactors), accounting systems, and HRMS platforms through pre-built connectors and APIs for automated repayment deduction coordination.

How do employees submit loan requests?

Employees can submit requests through the web portal or mobile app. They enter the loan amount, purpose, preferred repayment terms, and supporting documents. The system automatically validates eligibility and routes for approval.

Can I track outstanding loans and repayments?

Yes. The template includes dashboards showing outstanding loan balances by employee, repayment schedules, deduction amounts, overdue payments, and historical loan data. Finance teams can monitor and enforce repayment policies.

Is employee financial data secure and compliant?

Kissflow provides enterprise-grade security with data encryption, role-based access controls, audit logs, and compliance with SOC 2, GDPR, and financial data protection regulations. All employee financial data is handled with strict confidentiality.

Can approvals happen on mobile devices?

Yes. Kissflow's mobile app allows managers and finance approvers to review and approve loan requests on-the-go, view employee profiles, and receive push notifications for pending approvals.

What kind of reports can I generate?

The template includes pre-built reports for loan utilization by department, repayment performance, outstanding balances, default rates, program costs, and policy compliance. You can also create custom reports using the analytics dashboard.

How long does it take to deploy this across the organization?

Most organizations can set up and deploy the employee loan system in under a day. The initial template configuration takes about 10 minutes, and you can gradually roll it out department by department or organization-wide.

What happens if I need to make changes after deployment?

You can modify workflows, update loan policies, adjust eligibility criteria, or change repayment terms anytime using Kissflow's low-code editor. Changes can be tested in a sandbox environment before being pushed to production—no downtime required.