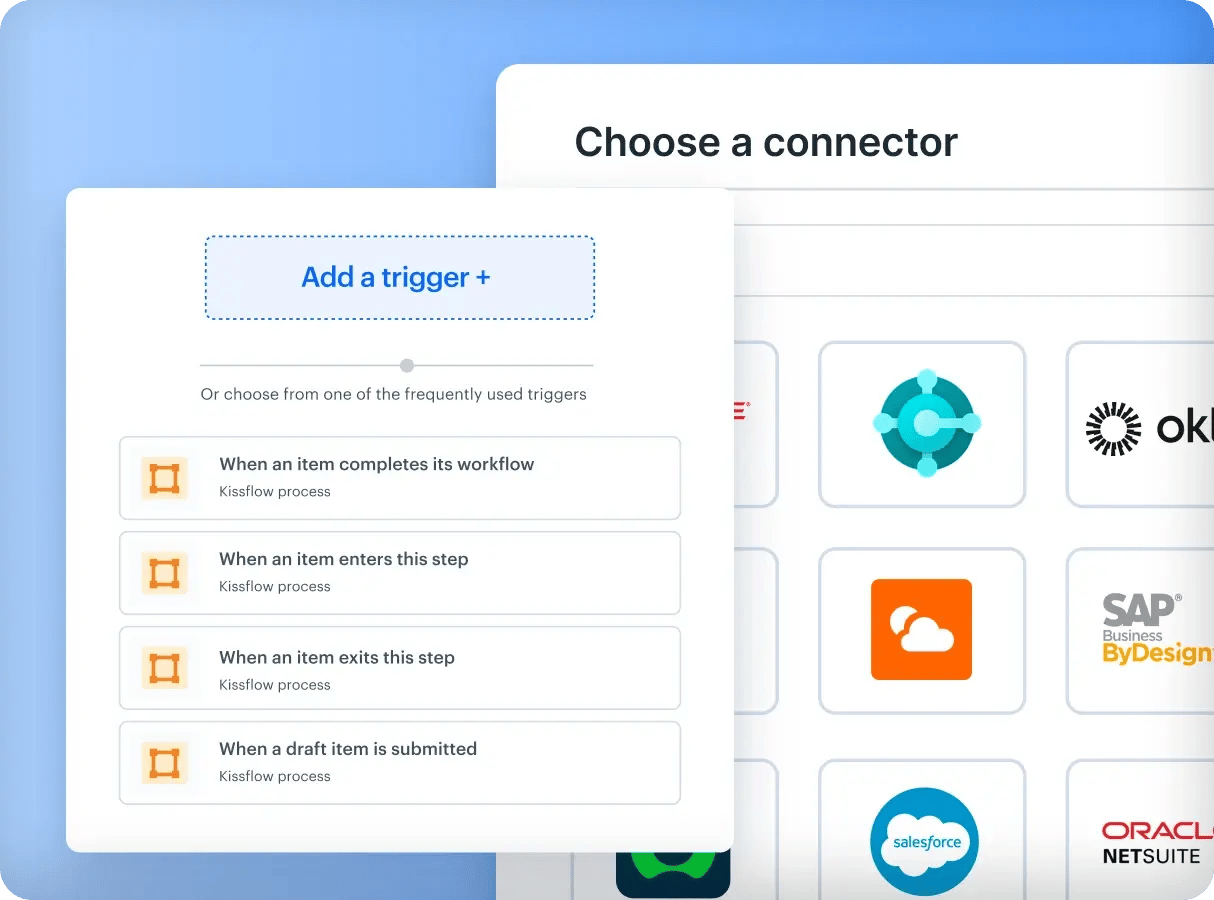

Streamline workflow creation

-

Design and automate forms with an intuitive drag-and-drop interface

-

Build sequences with parallel branches, conditional steps, and dynamic assignments

-

Set fixed or formula-based SLAs and manage notifications

-

Control, increase data visibility, and set rules for tasks and flows

.webp?width=550&height=496&name=banking%20(1).webp)